Partner badge

Global Strategic

Function

Finance

Industry

Banking & Capital Markets, Business Services, Consumer Products, Energy & Resources, Government & Education, Hospitality, Insurance, Life Sciences & Healthcare, Manufacturing, Media & Communications, Other, Retail, Technology & Software, Telecom, Travel & Entertainment

Region

Global

BCG’s innovative accelerator leverages Markov Chains and transition matrices to improve receivables forecasting accuracy.

Request a demoA cutting edge liquidity management tool powered by Anaplan

In times economic uncertainty, cash is king. With recent supply chain constraints, high inflation, and geopolitical uncertainty finance leaders are seeking to adopt new tools and approaches to develop timely and accurate cash forecasts.

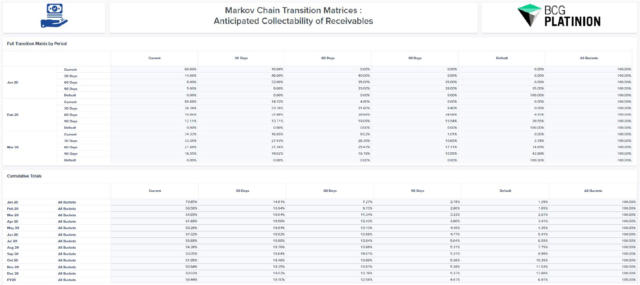

Our proprietary Receivables Forecasting solution on the Anaplan platform helps alleviate these issues by estimating the collectability of an organization’s outstanding accounts receivables. The tool evaluates the impact of counter-party risk to a firm’s expected cash collections and improves cash flow forecasting accuracy through the use of Markov Chains.

The Markov Chain method calculates the likelihood of receivables transitioning from one aging category to another. The technique leverages historical probabilities supplemented with forward-looking assumptions to derive transition matrices that depict these likelihoods over time. This allows business leaders to calculate the expected value of collections and track incremental changes in the status of receivables from one aging category to another.

Solution features

Key solution features include:

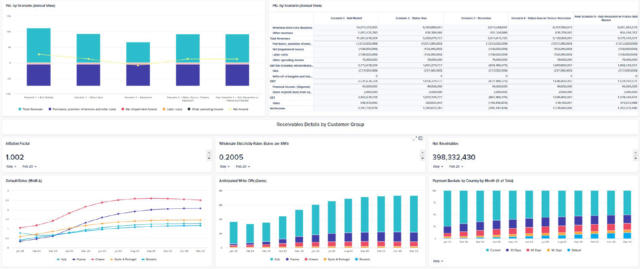

- Real-time Scenario Analysis: Create and compare multiple scenarios on the fly to facilitate quick liquidity related decision-making such as revolver draw-downs, payment term negotiation and overall cash management strategy

- Drill-down Capabilities: Deep-dive into specific areas of the business or individual customer segments to understand key cash drivers at a granular level, then rollup results to view impacts across the organization

- Embed Results into Top-Level Financial Forecasts: Seamlessly integrate financial impacts to accounts receivable line items into corporate level P&L, balance sheet and cash flow statements

- Integrate with External Data Sources: Seed model with third party data related to input prices, demand forecasts and customer credit info to provide the most up-to-date views of an everchanging financial landscape