Navigating the 2023 Gartner® Magic Quadrant™ for Financial Planning Software

Anaplan named a Leader and places highest in “Ability to Execute.”

As a finance leader, intelligently navigating an uncertain and volatile business landscape is critical for you to help your organization remain competitive. Having the ability to access data instantaneously to make fast, informed decisions will affect the magnitude of your topline growth and profitability. Rigid, inflexible, error-prone planning tools can no longer support steps to move your organization forward. Recognizing and leaning into the best available, cloud-native planning technology is imperative for you and your finance teams to meet demands placed on you to deliver on heightened financial expectations.

In this 2023 Magic Quadrant for Financial Planning Software (FPS), Gartner states “[o]rganizations use financial planning software to improve their financial planning and decision-making processes.” Gartner notes organizations “seek on-demand processes that extract value-added insights, aiding in identifying risks and opportunities vital for driving organizational value creation.” Having agile planning technology that facilitates quicker analysis, deeper insights, enhanced collaboration for better, data-backed decision-making can help advance your corporate objectives.

The 2023 Gartner Magic Quadrant for Financial Planning Software is a must read

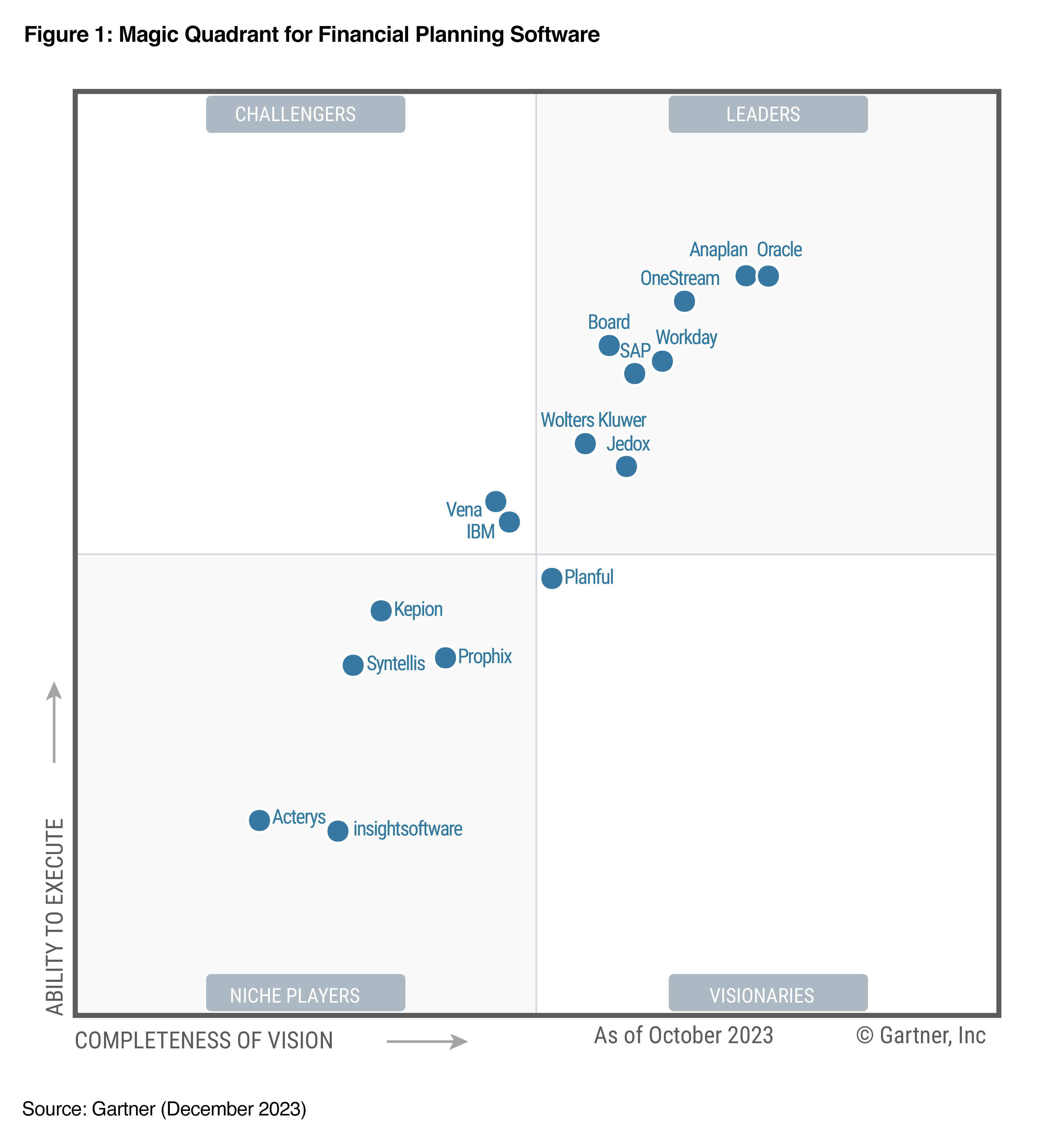

A Gartner Magic Quadrant provides you a graphical view of the relative positions of the vendors in four categories: Leaders, Visionaries, Challengers, and Niche Players. It evaluates the vendor’s 1) Ability to Execute based on their product/services, sales/marketing execution, and operations among other things and 2) Completeness of Vision based on their market’s understanding, business model and among other things. This report can help you determine which vendor’s solution is right for your organizational needs. In this Magic Quadrant, Gartner defines financial planning software as “the key tool that enables organizations to automate and streamline their enterprisewide financial planning processes. The software supports planning, budgeting and forecasting processes by connecting relevant operational and driver data to profit and loss, balance sheet and cash-flow financial statements.”

Anaplan continues its prominence in financial planning

With the publication of the 2023 Magic Quadrant for FPS, Anaplan has been recognized as a Leader for the second consecutive year. For the Gartner full evaluation of the market including Anaplan’s strengths and cautions, read your complimentary report.

Financial planning software facilitates FP&A transformation and covers planning, budgeting, forecasting, modeling, performance reporting, and agile insights.-- Gartner

As an FP&A professional or CFO, you recognize that market disruptions are persistent whether that’s prolonged inflation, high interest rates, or geopolitical unrests. These put significant pressure on you in developing growth targets and strategies in partnership with your leadership/executive team. That partnership is one reason that Gartner “anticipate(s) continued growth and transformation in the financial planning software market in the next five years. This transformation will be fueled by the increasing demand for FP&A leaders to actively guide their businesses through strategic decision making with more efficient planning and forecasting processes driven by AI and intelligent systems.”

Let’s delve into some of the trends that Gartner believes are important in financial planning and that may help you unlock insights and deliver greater value for your organization.

Cross-collaboration and enterprise-wide planning capabilities equal better collaboration

Achieving your goals requires planning alignment across the enterprise. Gartner recognizes that “stronger cross-functional collaboration is increasingly a key priority for organizations evaluating financial planning software.”

Finance leaders seek technology that support connecting financial goals and operational plans in sales/marketing, HR, and supply chain. With visibility into operational areas, finance can work with these functional leaders to identify and assess risks and opportunities to drive overall performance. Gartner notes that “the demand for better collaboration between different regions and functions is important to drive efficient and more meaningful forecasting and planning efforts.”

Advanced analytics and predictive capabilities for better decision-making

Meeting your customers’ expectations, reacting to macro market influences, and responding to business fluctuations while balancing financial performance requires an understanding of your numbers beyond traditional accounting to spot risks and opportunities. Therefore, finance teams like yours are seeking better ways to harness large volumes of data from internal and external data sources and leverage advanced capabilities to improve forecasting accuracy.

Anaplan customers use PlanIQ to take advantage of statistical and AI/ML-based forecasting techniques to help gauge the ideal path forward. Gartner cites, AI/ML represents “predictive forecasting and analytics capabilities are positioned to continually elevate the intelligence levels within financial planning, fostering improved business outcomes.”

How do these capabilities help you drive greater business value?

A CEO’s top priorities always include revenue and profitability growth. And the CFO and FP&A leader roles have evolved and now require them to be business partners and play an instrumental part in developing growth strategies and presenting steps to achieve them. To support all this, the CFO and finance teams must employ advanced planning tools to better understand business drivers across your business units, set meaningful and unbiased goals, and leverage scenario modeling and statistical algorithms to assess the impact of probable events to formulate contingency plans and uncover opportunities.

Utilizing agile financial planning technology that is flexible, scalable, dynamic, and business-owned empowers both your team and organization to pivot quickly and course-correct confidently.

We enable you to accomplish stronger results

In the Gartner survey1 of the “Top 10 Priorities for CFOs,” 83% of respondents selected “planning and sequencing finance transformation activities.” Also, a PWC Pulse Survey2 finds 53% of CFOs “plan to accelerate digital transformation using data analytics, AI, automation and cloud solutions.”

As a Leader in the Gartner Magic Quadrant for Financial Planning Software, Anaplan is ready to help your organization move away from rigid, legacy tools to Connected Planning to accelerate revenue growth, optimize costs, and mitigate risk. Are you ready to take your FP&A approach to the next level?

Gartner, Magic Quadrant for Financial Planning Software, By Regina Crowder, Matthew Mowrey, Vaughan Archer, 5 December 2023

GARTNER is a registered trademark and service mark of Gartner and Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from Anaplan

Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner's research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

1Gartner Survey Identifies the Top 10 Priorities for CFOs of 157 CFOs, January 2023, link

2PWC Pulse Survey of 722 executives and board members from Fortune 1000 and private companies, August 2022, link