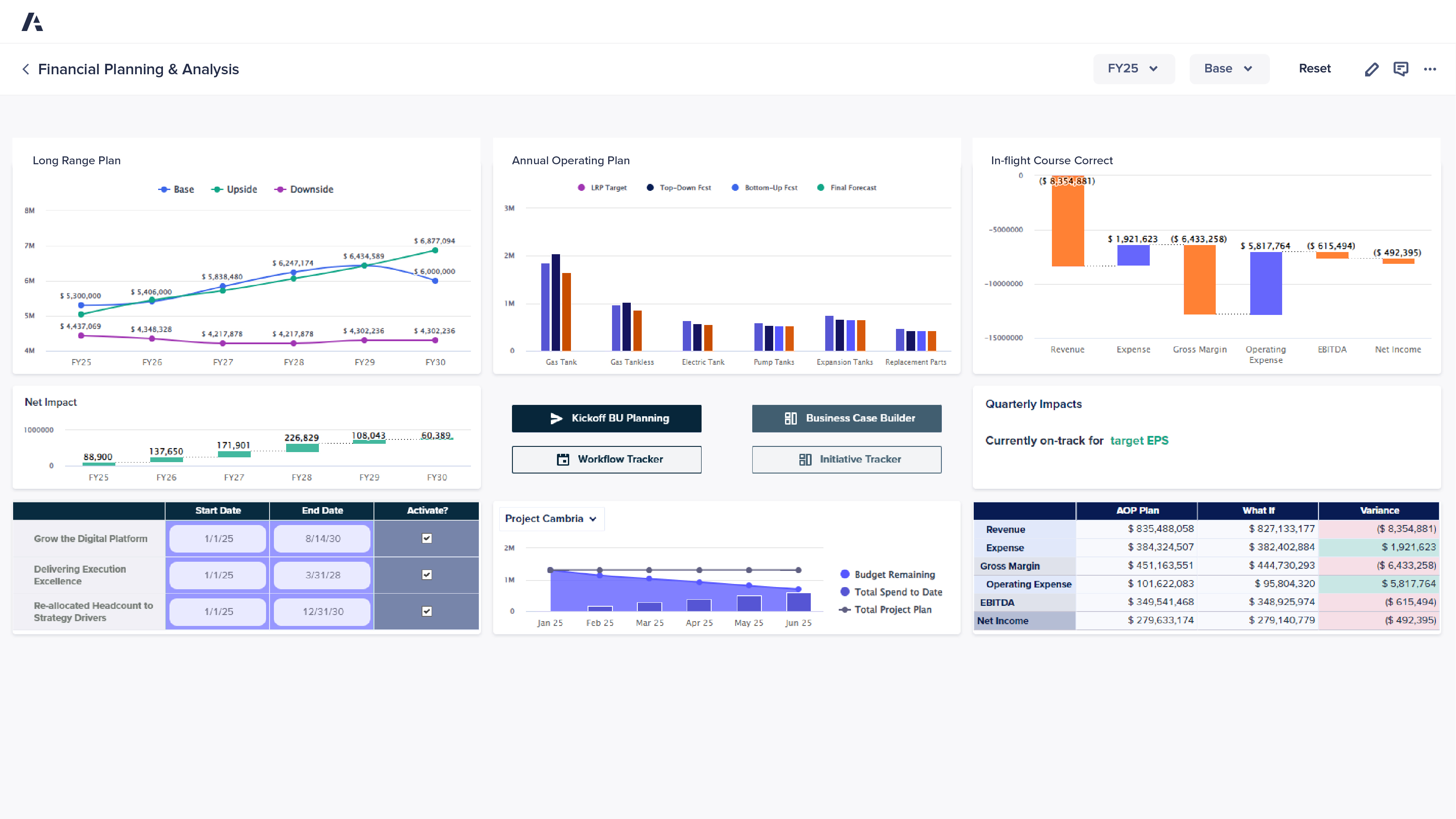

Financial planning and analysis (FP&A)

Align strategic goals and targets. Drive business efficiency with connected FP&A.

AI-infused scenario modeling and analysis solutions to align strategic, financial, and operational planning.

Drive stronger enterprise value with a best-in-class solution for agile planning and forecasting

2024 Gartner® Magic Quadrant™ for Financial Planning Software Report

Anaplan is named a Leader for the 3rd consecutive year in the 2024 Gartner® Magic Quadrant™ for Financial Planning Software

Connect across your finance organization with an integrated approach to FP&A

Enable FP&A teams to generate insightful financial performance projections for confident, data-driven decisions.

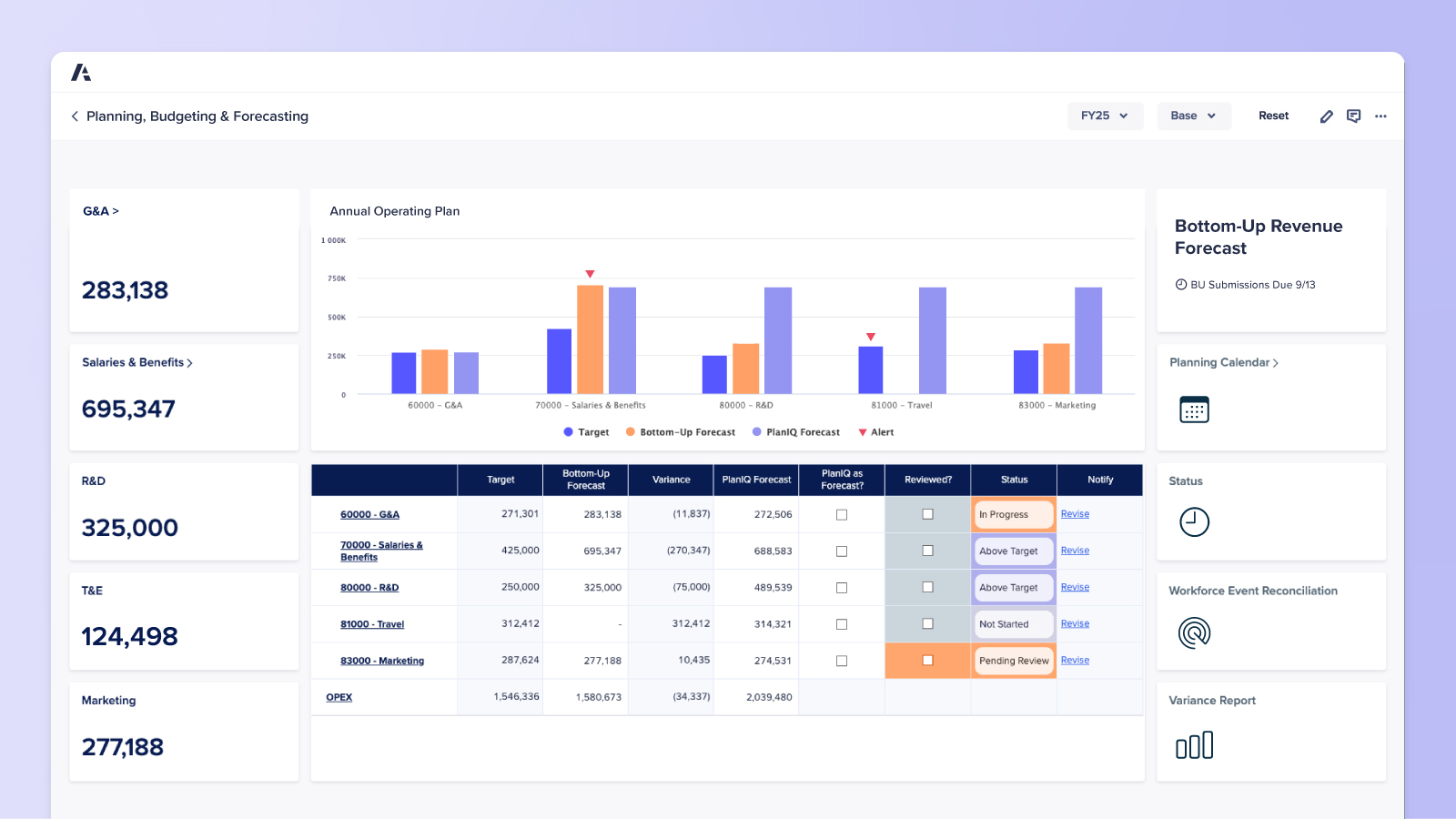

Planning, budgeting, and forecasting (PB&F)

Plan faster than the speed of business to boost productivity, enhance forecasting accuracy, and improve reporting precision.

Top finance leaders plan with Anaplan

Discover the platform finance leaders trust.

Be the next.

Finance teams around the world rely on Anaplan to build a modern, connected enterprise. Shouldn’t you?