The ultimate guide to zero-based budgeting

Learn what zero-based budgeting is and why organizations implement it to optimize resources.

Zero-based budgeting (ZBB) is the process of building your annual budget from zero each year to verify that all components are cost-effective, relevant, and drive improved savings. Implemented effectively, ZBB is a cost discipline enabling businesses to improve resource planning, employee engagement, and organizational collaboration.

Although ZBB is often credited with measures to reduce costs, its approach doesn’t exclusively focus on savings. It also helps test assumptions, solve problems, and ensure spending is aligned with your company’s growth objectives.

Organizations using an effective approach to ZBB report a multitude of benefits. In addition to increased cost savings, here are six benefits ZBB can provide:

- Improved business margins through cost savings and alignment of spending to strategic objectives

- A cost discipline focused on operational execution to support business growth

- Resource plans aligned to the projected future business state

- Enhanced staff engagement in budgeting, with a focus on “moving the needle”

- Culture of cost awareness and increased manager accountability

- Collaborative and unified budgeting among managers and planners

ZBB, done right, frees up your organization’s funds for future strategic initiatives and growth.

How is zero-based budgeting different from traditional budgeting?

Traditional annual budgets are often created by taking the previous year’s actuals and adding a few percentage points to account for wage increases and inflation. This simplistic and incremental form of budgeting can lead to inefficiencies and missed overlooked cost-saving opportunities.

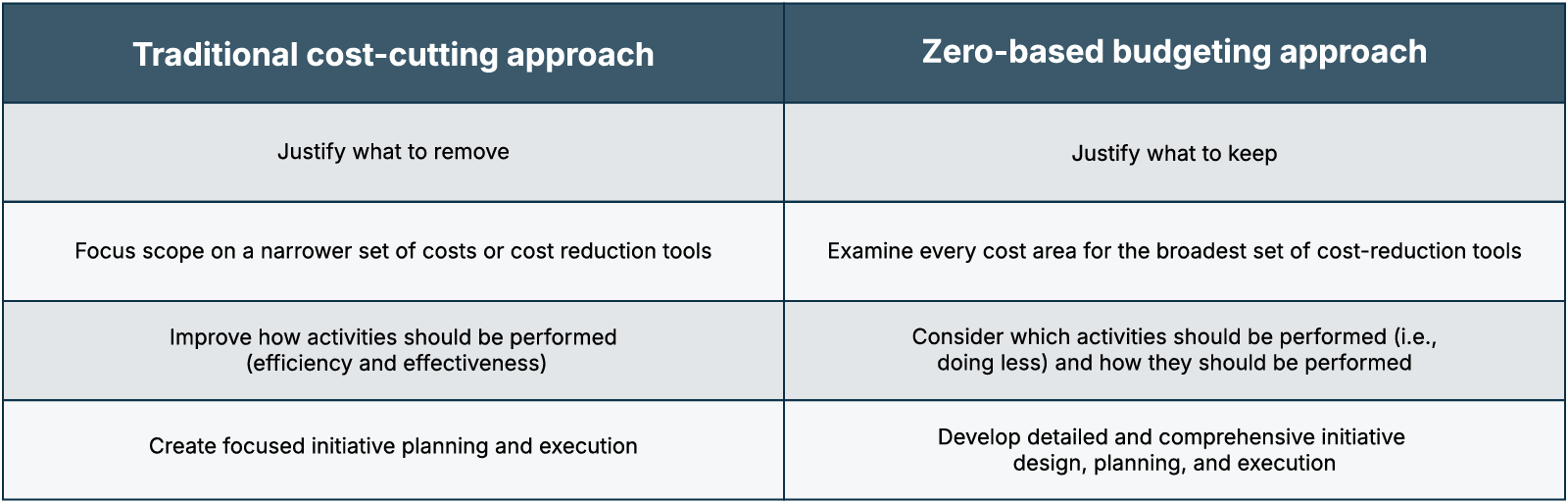

We break down the core elements of ZBB in our white paper, but here’s a quick comparison of traditional cost-cutting and a zero-based approach:

Why is zero-based budgeting top of mind again?

ZBB approaches were difficult to achieve in the past because they were simply too complex for spreadsheets and manual planning environments. Legacy planning systems added further complications with architectures that grappled to provide the flexibility needed to amend models.

Advancements in planning technology enabled businesses to re-evaluate the opportunity of ZBB and successfully implement it within the organization. By leveraging modeling platforms not limited to specific or expected financial line items, businesses can model any process required for their planning needs. This allows them to implement ZBB quickly and effectively for fast, agile, and dynamic budgeting cycles.

Companies using ZBB report cost savings between 10 and 25% — vital savings that can be used to bolster their margins or invest in future growth. Unlike broad, top-down cost-cutting measures that can hurt service quality and reduce revenue, ZBB focuses on doing what matters most in the most cost-effective way. This can provide a low-risk approach to transforming the cost base while leaving companies adequately resourced and well-financed for future growth.

Zero-based budgeting in five simple steps

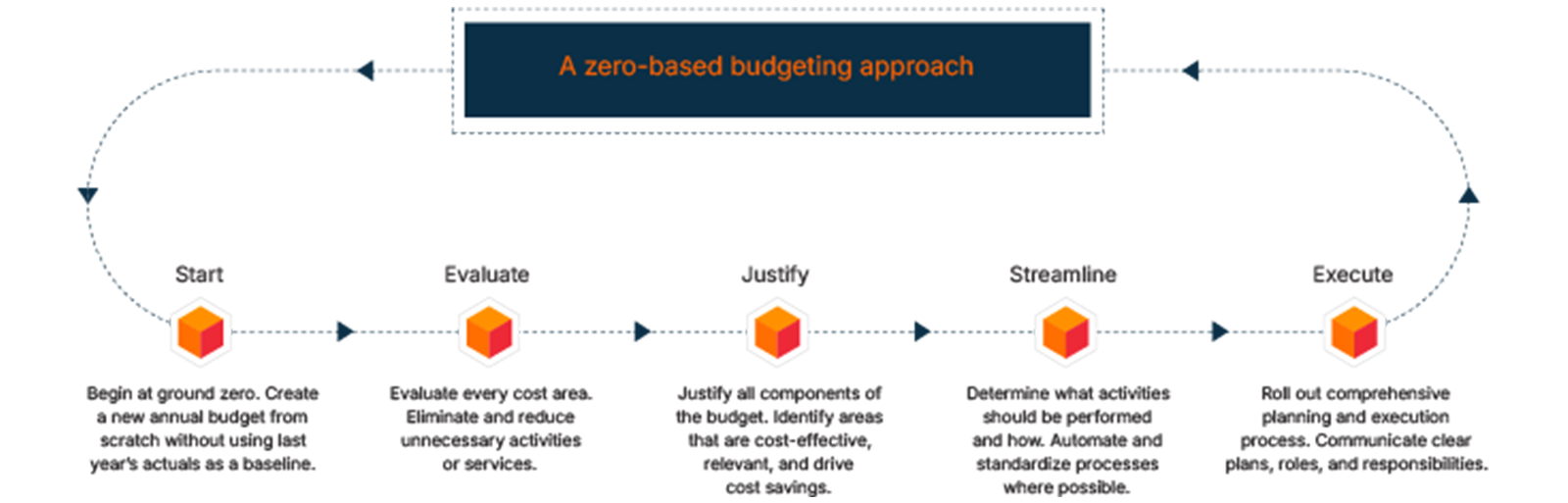

Your business can develop or modify its own unique approach to ZBB, grounding the process in the conviction that all spending has a purpose aligned to the strategic goals. The following five steps can provide a baseline for implementation:

Zero-based budgeting best practices

Adopt a positive approach. ZBB is more than just slashing costs. It’s a necessary step for freeing up the resources and funds needed for business renewal and growth initiatives. Working with business leaders, you can use internal and external benchmarking to illustrate profitability gaps and explain exactly what will happen to the savings.

Identify the quick wins. Initially focus your ZBB initiative either on the larger and more stable business units struggling with profitability, or selected areas of overhead (such as sales, general, and administrative expenses) where there are large indirect costs not clearly understood. Not only will such choices reinforce the rationale for undertaking ZBB, but they will also deliver the largest cost savings with minimal disruption.

Don’t do it alone. Assemble a cross-functional project team with members from finance, IT, and other relevant business units, and preferably chaired by a C-level executive. The core of ZBB is the challenge and review process — evaluating every activity a department undertakes to see if it can be stopped or done more cheaply.

Select the right planning platform. The success of ZBB depends on having detailed insight into the operational drivers of costs, such as activity volumes, productivity ratios, and input costs — none of which are contained in traditional planning and budgeting software. These older systems contain highly aggregated financial data and typically need to be supplemented with considerable amounts of data from elsewhere, such as spreadsheets. Manipulating this data in ancillary spreadsheets increases both the complexity and workload involved in any ZBB initiative. A better alternative is to hold all the detailed operational and financial data on a single financial planning and analysis solution.

Plan for sustainability. Once you implement a successful ZBB project, keep your skills fresh by moving on to other business units or expense categories and revisiting previous projects to ensure the savings stick. Don’t mothball your ZBB model either. Because it captures the causal relationships between activities, the resulting resource needs, and their associated expenses, the ZBB model can be developed into a driver-based planning and budgeting tool. This model can effectively supplement or even replace existing FP&A processes. Successful ZBB projects should result in a heightened awareness of cost control. Keep in mind that awareness won’t happen if the organization returns to the traditional incremental approach for annual planning and budgeting once the implementation is over.

How to get started with zero-based budgeting

1. Integrate ZBB with core FP&A.

ZBB should not be seen as an alternative to current planning and budgeting cycles, but as an auxiliary process carried out every couple of years to refocus spending on strategically important activities and initiatives.

2. Focus ZBB initiatives for maximum returns.

Many companies limit their ZBB initiatives to selling, general, and administrative (SG&A) expenses, as well as other areas of overhead where there are large amounts of indirect costs less well understood. This allows targeting specific parts of the organization and gaining major benefits for a limited investment without overly disrupting customer-facing business functions. Others choose to limit their use of ZBB to new business initiatives and requests for additional funding while using other methods of budgeting for ongoing activities.

3. Unify operational and financial data on a single platform.

The success of ZBB depends on managers having a deep understanding of and visibility into the operational drivers of costs. Providing such visibility means having granular details of cost (right down to an individual employee, a business trip, or a marketing campaign) and easy access to data around activity volumes, productivity, and resource consumption.

4. Make modeling easy.

The ability to model the causal relationship between activity volumes and the resulting resource and headcount requirements is critically important. Managers need to make informed decisions about how changing activity volumes and different service levels impact costs.

5. Re-use ZBB models for routine FP&A process.

If an organization uses an incremental approach to planning and budgeting based on the previous year’s actuals, the ZBB model will be the first enterprise-wide model of causal relationships linking activities of different business functions. FP&A teams should adapt the model as needed to support the annual budgeting process and rolling re-forecasts, which will become more efficient and deliver greater insight. Repurposing models in this way means ZBB is no longer a standalone exercise, but an initial step in transforming enterprise planning and budgeting that could lead to fully integrated business planning.

For ZBB to be successful, it needs to be modeled and delivered through a capable and flexible planning solution. Our Integrated Financial Planning application is cloud-native and enables, supports, and executes effective ZBB methodologies even in today’s increasingly volatile business environments.