5 things to learn customer profitability analysis

I recently wrote about the importance of improving the accuracy of profitability analysis, by using more appropriate drivers that better reflect the way the target products or customers consumes indirect expenses. In this piece, I’ll focus on how you can use that information when it comes to managing customers. But before I get into that, let me point out that I’m not necessarily advocating analyzing every single customer. If their purchasing behavior is fairly homogeneous, you can get reliable and actionable results by grouping them by size or channel, leaving only the key accounts that enjoy special discounts, or require non-standard fulfilment, to be treated individually.

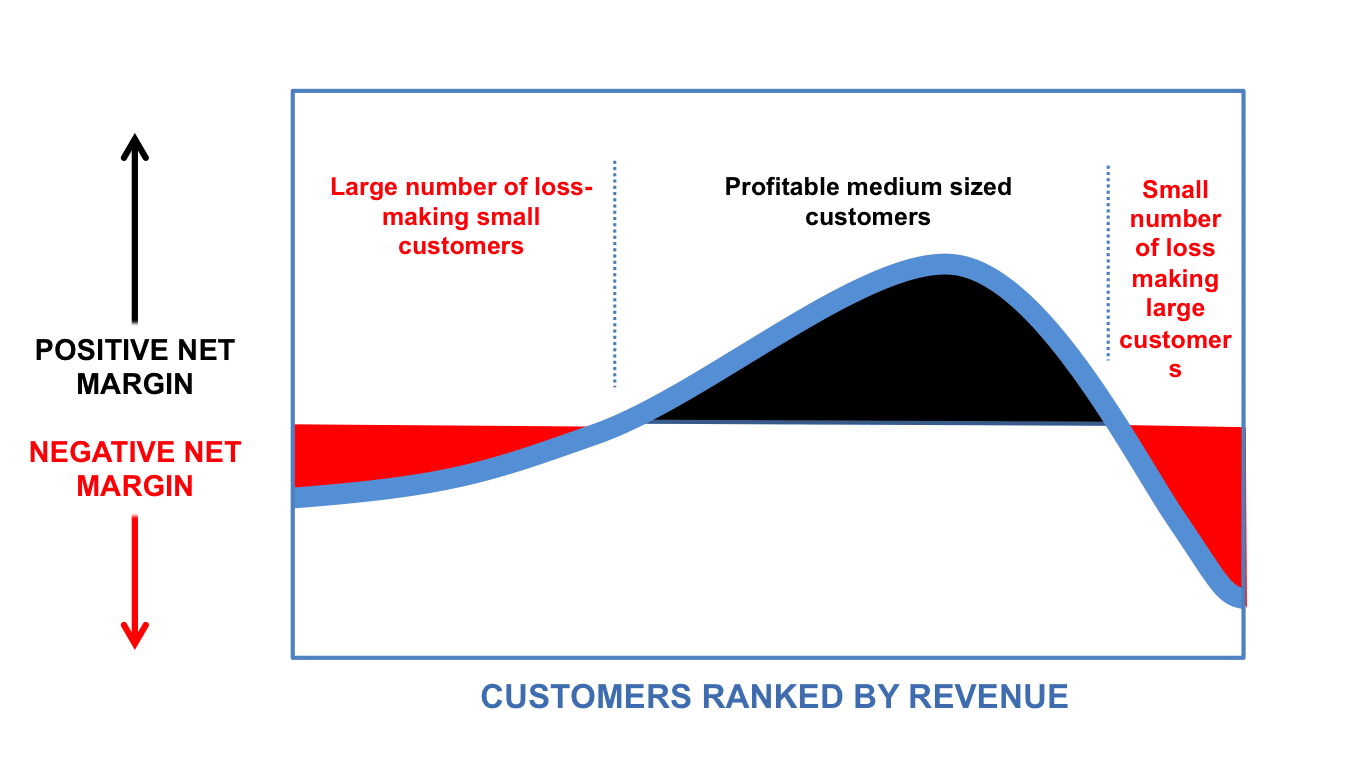

Not all customers are equal. But somewhat counter-intuitively, it is frequently not the ones that account for the lion’s share of the revenue that generate most of the profit. All too often, these large accoprounts have such bargaining power that they already enjoy large discounts and generous payment terms. But once indirect expenses such as selling and support costs are factored in, they frequently turn out to be loss-making. At the other extreme are the plethora of occasional customers that never purchase enough to cover the cost of setting up and administering their account. As a result, when net margins are plotted against customers according to their revenue, you get a graph like the one below.

Now, while many customers may not be generating a positive net margin, most will be making some contribution to overheads. So it is detrimental to overall profitability to fire customers unless you have first identified whole tranches of indirect expense that can be successfully eradicated as a result. A better alternative is to implement a raft of incremental improvements to increase gross margins, and make it cheaper to do business with the customers you already have, rather than going out and winning new ones. So here is my list of the five key things you can learn from your customer profitability analysis that you can put into action:

1. Focus your acquisition spend

Now you know exactly who your most profitable customers are, make sure the marketing strategy is based on winning more of them. Don’t waste big budget dollars retaining unprofitable customers or making it difficult for profitable customers to do business with you. That is not to say that every customer needs to be profitable. Having a few unprofitable key accounts that make a significant contribution to overheads may make sound commercial sense.

2. Target your retention activity

Likewise, make sure retention activity is not wasted hanging on to loss-making customers. Also ensure that your customer contact teams are aware of which group of customers are the most valuable to the business. It’s key to then in turn empower reps to quickly ameliorate any occasional service failures with credits and free product to keep these customers happy.

3. Rework your discounting policy

Knowing how net profitability varies with customer size gives you important insights that once paired with data about product profitability will help you formulate a commercially driven discounting policy. At the same time, you are likely to uncover instances where unprofitable customers enjoy special discounts that were based on projected volumes that were never achieved. In addition, business to business customers will be enjoying volume related discounts, retrospective rebates and early settlement discounts, all of which need analyzing in considerable detail.

4. Revisit your channel strategy

One of the key reasons customers are unprofitable is because the costs of doing business with them is out of step with their potential for profit. This can be anything from sales people calling too frequently on customers with limited potential or even telephone selling to customers who should really be ordering online. Moving such customers to self-service sales and service channels results in cost savings. That savings can be used as introductory discounts to smooth the transition to this new service model, and reinforce the behavior.

5. Plug the holes in your terms of business

Many customers fail to generate any profit because they only place small orders where the contribution fails to meet the cost of order processing and fulfilment. Reviewing minimum order quantities can do a lot to keep the costs of doing business with a customer better aligned with the amount of business they give us. But, I’ve always been an advocate of subtly incentivizing customers either to change their behavior. This can include encouraging the use of lower cost, self-service channels, or incentivizing them to buy more product by making attractive bundles or by having a minimum shipping charge – or free delivery over a certain order value.

I hope I dispelled the myth that better profitability reporting is difficult and time consuming in the first post on this topic – and whetted your appetite for customer profitability in this brief piece. Most companies already have much of the data needed to analyze customer profitability. And with a little digging into how sales people spent their time, freight systems, purchase histories, marketing budgets, payment terms and the like, soon this data produces sufficient information to put something in place. The sooner you begin, the faster you’ll start to understand how profitable your customers really are and understand exactly what to do to bring about improvements.

For more detail of what this could look like and key insights regarding advanced decision making in every part of your business, register for one of our live presentations.