Resources Library

Your guide to actionable insights

Find the latest industry best practices, eBooks, white papers, research reports, and more.

Top featured resources

What’s Next: Anaplan Intelligence and Product Innovations

Leading industry research at your fingertips. Explore top analysts’ reports in one place.

Anaplan Enterprise Decision Excellence Report™

Life sciences: Beating tariff shocks with AI-driven forecasting

BARC Analyst Report: The Planning Survey 25

Anaplan Operational Workforce Planning application

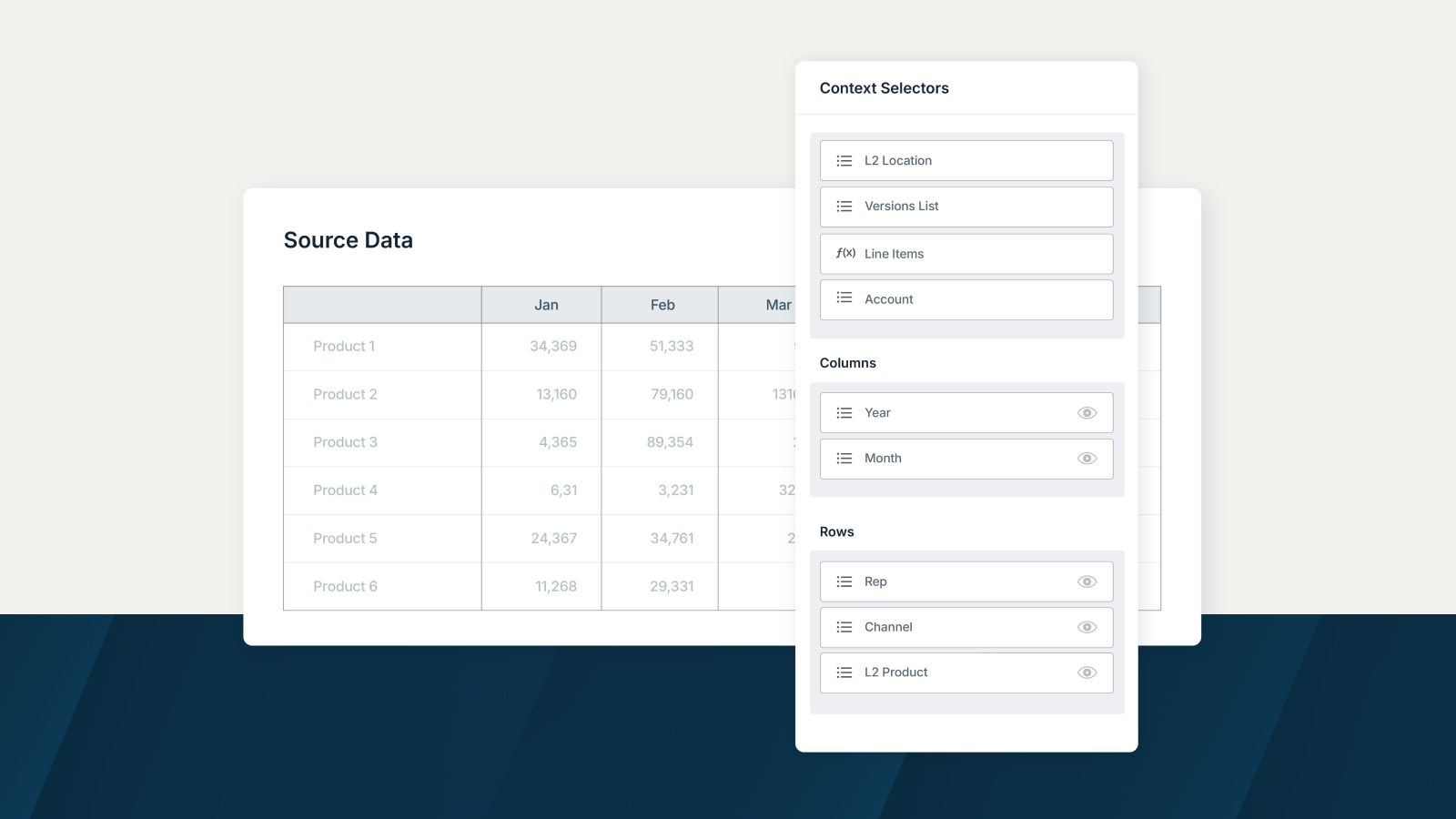

Anaplan Polaris Calculation Engine brochure

Supply Chain Transformation Solution Brief

Accelerate Growth with Smarter Account Segmentation and Scoring

BestSecret’s journey to more effective merchandise and assortment planning

Anaplan for Oil and Gas Solution Brief

2025 ISG Buyers Guide™ for Retail Supply Chain Planning: Software Provider and Product Assessment