Why FP&A can help bridge the SEG

Part 2: Why FP&A can help bridge the SEG

There are only two types of companies in the world; those that know they’ve got a Strategy-Execution Gap (SEG) and those that will realize it, sooner or later.

Let’s face it, shift happens. It’s the ability to adapt to the constantly shifting business landscape that defines success. When a disconnect occurs - and it does within most organizations - the SEG forms and growth becomes nearly impossible.

In our previous blog, Identifying the Strategy Execution Gap, we discussed and defined strategy, as well as explored some of the reasons why companies experience the SEG. In part 2, we will draw upon our recent report Empowering FP&A to Bridge the Strategy-Execution Gap to understand why FP&A teams are ideally positioned to help achieve strategic success.

One of the challenges organizations face today is the rapid and constant pace of change. In the past, traditional FP&A could create predictions and forecasts up to a year in advance with quarterly updates to support this single version of the future.

However, the current business environment demands a different approach. Integrated FP&A leans on the vast amount of data available within your organization (and in the market) to assess and support the impact of multiple potential futures. This results in more agile decision-making across multiple scenarios at a faster pace.

Want to find out more about the latest trends impacting FP&A? Watch our webinar here and discover the transformations ahead with practical tips to help you overcome the challenges.

In the Driver’s Seat

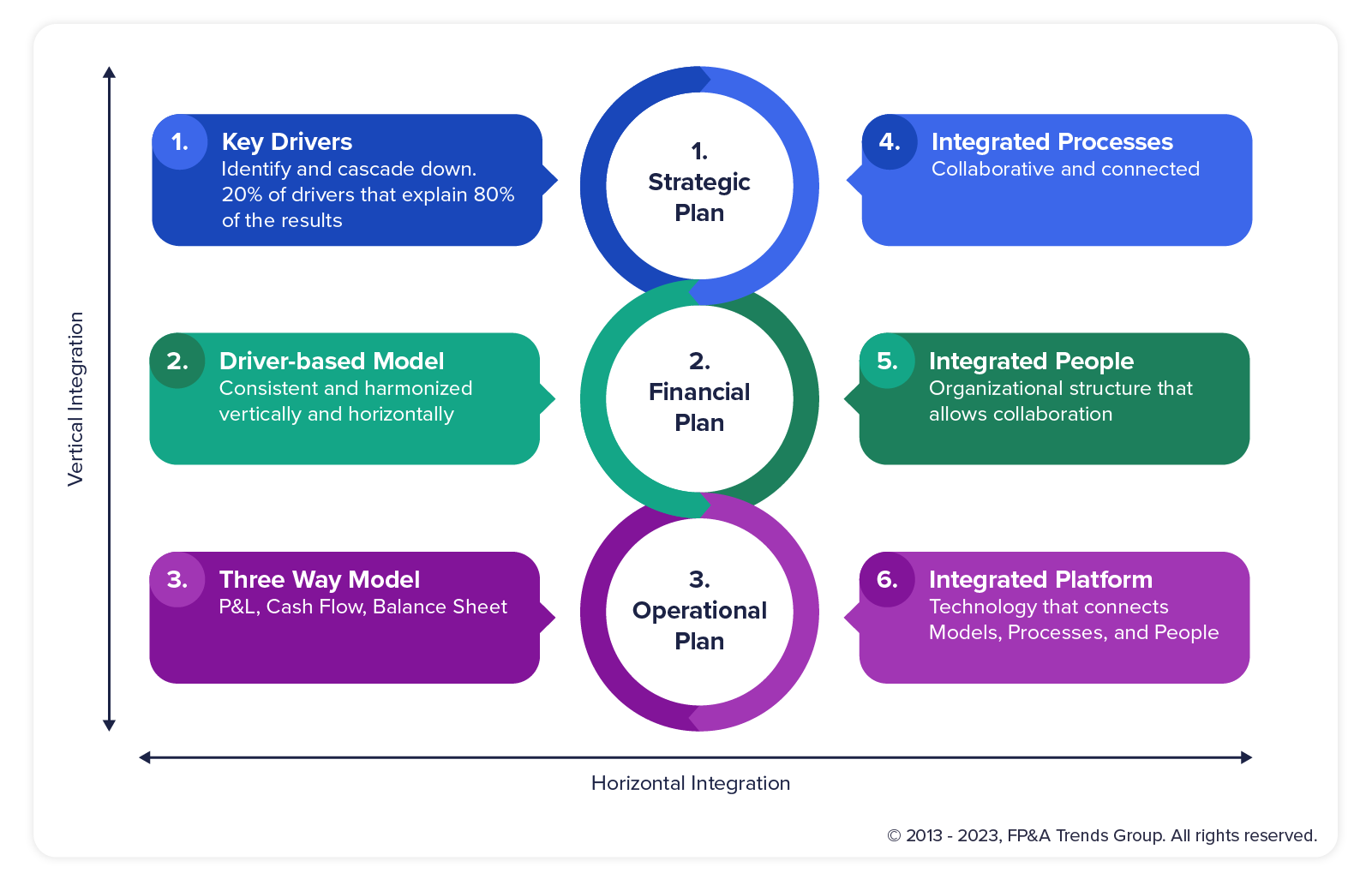

Our research found six key areas where integrated FP&A will transform the creation and execution of your strategy.

The first three of these involve discovering the main drivers or influencers that have the biggest impact on your financial results and using them within predictive modeling to understand possible futures.

In traditional FP&A this would take weeks, reams of reports and countless emails to get data from across the business. However, with integrated FP&A, you can quickly discover correlations between actions and outcomes, incorporating outside influencers such as seasons or market trends.

There are also internal departmental drivers, and according to Jack Alexander, author and thought leader, these should be modeled separately depending on what they contribute to the business. These can include (but are not limited to) new product launches, retaining and growing existing customers, new customers, market trends, acquisitions, and the competitive environment.

By recognizing the role each plays in your business and understanding the key drivers behind them, you can better model performance, which means you can better predict your future and maximize untapped opportunities. And, with Integrated FP&A, you can use planning models to produce predictive financial statements that include P&L, balance sheet, and cash flow – rather than just the P&L most organizations produce - aiding faster, better decision-making.

The final three areas where integrated FP&A can transform your business are all focused on deeper interaction and interconnectivity between the holy trinity of people, processes, and technology.

“It’s important that you talk to the people on the shop floor to explain what it means to them and what are the actions for them to carry out. It has to resonate with them.”

1) Integrated Processes

To achieve integrated processes, we found that key organizational activities – strategic planning, operational planning and financial planning - should be considered as a single, continuous process. This allows you to achieve a consistent story about how your organization intends to meet its strategic objectives and enables agile re-forecasting and scenario planning.

This integrated process is characterized by six activities:

2) Integrated People

It’s not only the processes that need to be interconnected; the people need to be integrated too, and it’s up to the FP&A team to build cross-functional, cross-departmental partnerships that collaborate on strategy and execution.

To achieve a strategic and influential role throughout the organization, our research identified five key roles, plus two emerging roles, that are essential for every FP&A team:

- FP&A Analyst: Analyzes data, produces reports, and evaluates projects and investments.

- FP&A Data Scientist: Skilled in using predictive technologies such as AI/ML to uncover drivers and trends for planning models.

- FP&A Architect: Acts as a bridge between IT, Finance and Corporate Strategy. They hold the ‘big picture’ of how it all fits together.

- FP&A Storyteller: Presents results in the context of decision-making in a way that is engaging and easy to understand.

- FP&A Influencer: Works with and influences senior executives on the actions and decisions and their implementation.

- FP&A Connector (emerging role): Links everyone, everything, and every department given their understanding of the entire business, pain points and solutions.

- FP&A Interpreter (emerging role): Sits between the business and the analyst providing the raw materials for the FP&A storyteller.

FP&A plays a role that extends beyond the finance department. Therefore, FP&A teams need to develop a range of technical, hard and soft skills, including accounting and performance management, analytics and data management, business strategy, critical and strategic thinking, communication and collaboration skills, as well as have an eye for innovation.

3) Integrated Platform

Like a box of Lego, an integrated planning platform can be designed to meet your specific needs and is adaptable to change at any time.

It provides a set of common building blocks that connect your systems and processes, aligning strategy with execution.

Before implementing an integrated platform, consider how to derive the most value from the system. One company’s implementation included:

- Automating transactional work

- Ensuring simulation and re-planning agility

- Improving forecasting accuracy

- Utilizing data visualization and analytical capabilities

“AI/ML technology can aggregate and process data with far greater speed, gives better insights, accuracy, and scalability than is humanly possible.”

Cloud-based and accessible anywhere, connected platforms increasingly employ AI/ML to process large amounts of data quickly and leverage external data sources to help assess the impact of market conditions.

To discover invaluable insights on how to overcome traditional planning challenges and drive business agility with Connected Planning watch our webinar here.

So, after reading this, which business is yours? The one who knows about their SEG and is being proactive and doing something about it, or the one who hasn’t discovered it yet? To thrive during the shifts that happen, read our full report here and discover more about how FP&A can help bridge the SEG.

Coming up in Part 3

In the final part of our series, you can find out how FP&A can bridge the SEG, why Scenario Management should be at the core of your business, and some practical tips and tricks to help you prevent and overcome the SEG.

About the authors

Michael Coveney, Head of Research at FP&A Trends Group, has over 40 years of experience in designing and implementing software solutions that combine ‘best management practices’ with technology to improve the efficiency and effectiveness of planning, budgeting, forecasting and reporting processes. He has conducted senior management workshops with leading organizations around the world and led courses for the American Management Association and Antwerp Management School on the topic of Corporate Performance Management. His energetic style and extensive experience led him to become a regular speaker at many international events and the author of many articles and books. His latest, ‘Budgeting, Planning and Forecasting in Uncertain Times’ is published by John Wiley & Sons. In recent years he has focused on the role of IT within FP&A departments.

Larysa Melnychuk, CEO at FP&A Trends Group, is an accomplished FP&A professional and thought leader with over 20 years of experience in senior finance roles at top-tier companies. In 2016, she founded the FP&A Trends Group, a global organization that offers valuable insights, advisory services, and training to finance professionals seeking to stay ahead of the curve. Under her leadership, the FP&A Trends Group has conducted 20 innovative research and insight projects, including the widely recognized FP&A Trends Maturity Model. She also created the International FP&A Board, which has held over 200 meetings for finance leaders from 30 chapters across 16 countries on four continents. As a founder of the AI/ML FP&A Committee, Larysa is committed to promoting excellence and enhancing the profession globally.

1 Strategy&. The Strategy Crisis Insights from the Strategy Profiler [Online] 2019.

Available from: https://www.strategyand.pwc.com/gx/en/unique-solutions/cds/the-strategy-crisis.pdf