Research reveals 5 insights on the impact of planning to business outcomes

Business planning is undergoing major disruption. With technology advances in data collection and analysis, cloud computing, and mobile communication, businesses now have unprecedented power to make better, faster, more intelligent decisions. What factors generate business success, and what holds companies back?

From a recent Anaplan-sponsored survey of more than 1,000 business decision makers, Dimensional Research shares five insights that can impact your company’s planning effectiveness and improve business outcomes.

#1: Planning is critical to the business

Good planning will improve outcomes across your company and be a key differentiator. Not only does effective planning empower organizations to make better decisions today, it prepares them to overcome the unexpected changes in company priorities and market evolutions that will inevitably occur tomorrow. Business planning decision makers couldn’t agree more, with 82 percent characterizing planning as “critically important.”

#2: Planning happens more frequently now than in the past

Today, business leaders increasingly believe that in a business world that constantly changes, static plans provide little value. Thriving companies are now seizing more control of their destinies by implementing an always-on planning mode where they assess the impact of change more frequently and adjust their plans continuously. When asked about the regularity of their planning, three-quarters (74 percent) of business planners say they are planning more frequently now than in the past.

#3: Planning needs to be improved

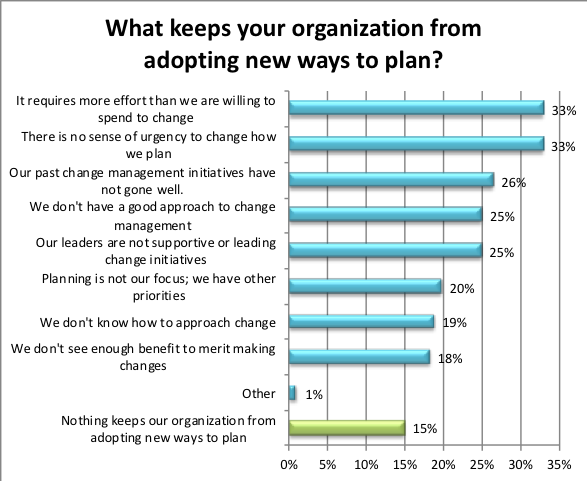

Organizational planning is often a complicated activity involving multiple business functions and people, a plethora of applications, and inconsistent processes. There are a wide range of potential roadblocks that can get in the way.

Most business planners (85 percent) report that they face barriers to adopting new ways to plan. These include requiring more effort than companies are willing to spend to change (33 percent), lack of urgency in change planning approaches (33 percent), past change management initiatives that have fared poorly (26 percent), no good approach to change management (25 percent), and no support from leaders in leading change initiatives (25 percent). Consider what keeps your company from adopting new ways to plan and how you might remove those barriers.

#4: Companies struggle to do better with their planning

In light of the planning shortcoming that hold companies back, there is a strong desire to do better. A whopping 96 percent of business planners say their planning approaches must change. Specifically, they want to increase collaboration across teams and departments (52 percent), make faster decisions (47 percent), implement better technologies to support planning needs (42 percent), and plan faster (35 percent).

In order to move forward, companies must address their planning challenges head on. In fact, 87 percent of business planners report that major challenges are stopping them from planning more effectively.

#5: Technology is vital to increase planning effectiveness

An important takeaway from this research is that 97 percent of participants report that new technological capabilities can enhance their planning efforts. Business planners describe the most valuable technology capabilities as those providing integration into existing technology and applications (52 percent), a collaborative platform used by all (48 percent), flexible business modeling with “what if” scenarios (47 percent), predictive analysis that anticipates modeling outcomes (46 percent), and market and industry data for better modeling (42 percent).

Research Methodology

The research was conducted by Dimensional Research on behalf of Anaplan. A total of 1,036 decision makers with responsibility for business planning completed an online survey.

To read more about the survey methodology and get a detailed overview of these findings and more, download the complete research report.