Unlock hidden procurement cost savings and reduce risk

Supply chain, procurement, and finance teams face endless challenges.

Teams trying to connect financial plans to supplier spend and keep pace with constantly changing market conditions feel helpless. They need to monitor supply chain performance to make timely decisions and act with agility.

In many cases, teams are not able to efficiently analyze data trapped across financial planning systems, procurement execution solutions, and supplier tools.

The status quo isn’t working

Oftentimes, departments needed to constantly export data to spreadsheets and use email to keep suppliers, factories, warehouses, and other groups updated about shifting availability and pricing. By the time the data was created, emailed, and responses sent, the markets had changed.

Time-consuming and fragmented business processes are driven by copious spreadsheets, documents, point solutions, calls, emails, and meetings. Finance and procurement teams can spend up to 40-50% of their time doing only this spend analysis.

It just doesn’t work today, where things change at the speed of sound. The teams’ time needs to be spent strategically raising supplier performance or working to uncover deeper cost savings opportunities across categories rather than chasing details that may already have grown stale.

Link finance and procurement for seamless collaboration

Chief Financial Officers and Chief Procurement Executives need improved visibility into sourcing decisions if they’re going to deliver the highest possible return on investment. By connecting finance and procurement functions directly, the ability to increase cost savings, reduce risk, and improve visibility and resilience is unlocked.

Procurement and finance leaders working together directly benefit from the ability to improve future budgets and negotiations with suppliers by enabling closer review of overall planning to spend accuracy. Teams also benefit from better governance decisions based on more adaptability to changing business conditions. If a budget misaligned and a rebalance is needed, the teams are empowered to do so with more information.

It can seem daunting or even impossible to link the two, but it’s more possible and more beneficial than you may realize. Connected plans allow finance and procurement to better provide strategic “what-if” analysis; enable global scenario modeling for sourcing; generate multi-year forecasts by category, commodity, or suppliers; and streamline the time needed to generate future-year budgets.

Global companies are reaping the benefits

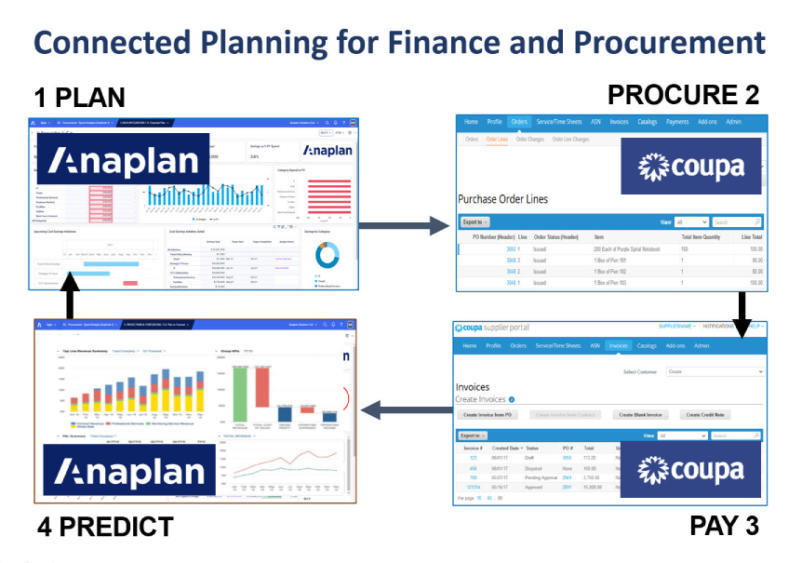

A global technology company implemented Anaplan with our new partner Coupa, a business spend management solution, as part of a modernization and transformation evolution. Linking Anaplan’s financial planning and budgeting solutions to Coupa’s business spend management capabilities gave them a unified view of their budget’s past, present, and future. The joint solution integrates budget data from Anaplan with order and payment data in Coupa to create an innovative Master Data Management (MDM) model that helps align key data across disparate systems.

The resulting automation and standardization benefits the entire company. Automation cuts down mundane tasks and makes them more accurate, which delivers substantial time-savings, and standardization removes complexity and enables people to move easily between projects. Automation and standardization also help with process improvement, and that yields the most important business benefit of all: Agility in a changing business environment.

Conclusion

Regardless of the software you use, the need to connect finance to procurement is paramount. Doing so allows new levels of collaboration and accuracy in procurement spend. From negotiations to re-forecasting, the benefits are manifold and simple to execute with our partnership with Coupa.