Why xP&A is the future of corporate planning

What is xP&A?

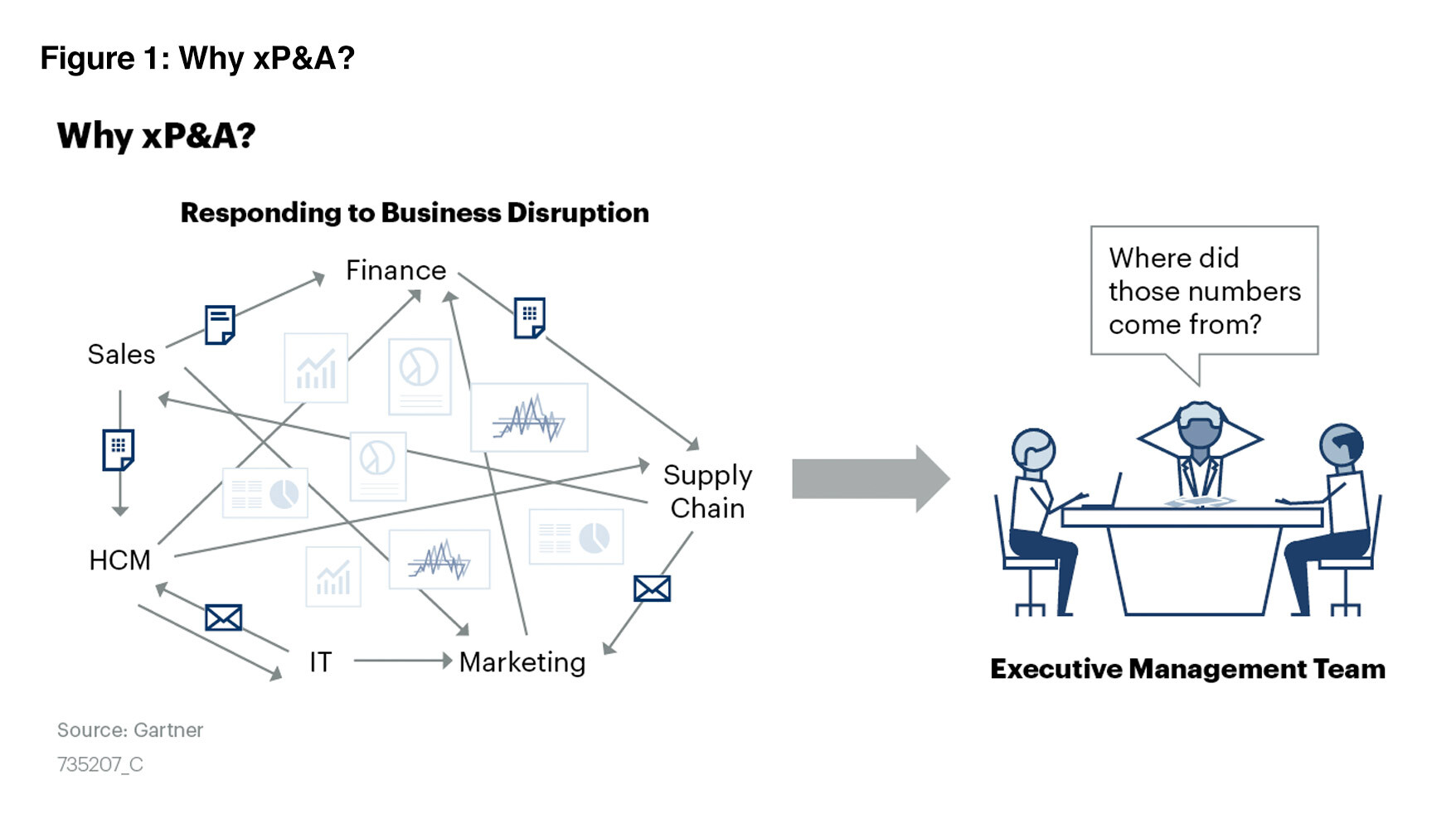

It’s official – financial planning alone isn’t enough if you want to succeed. That’s what leading analyst firm Gartner revealed in 2020 when it coined the term Extended Planning & Analysis (xP&A).

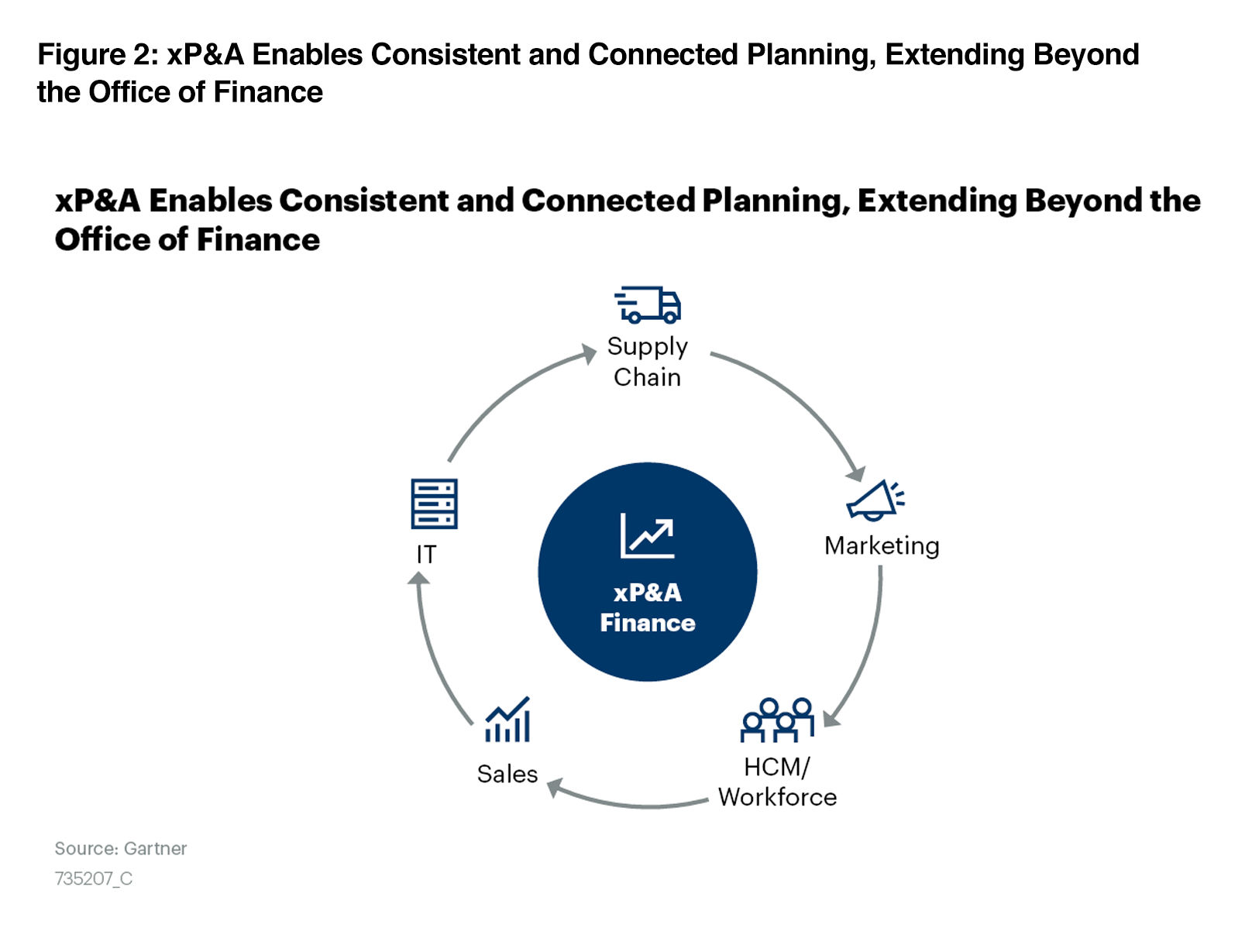

According to the global research and advisory firm, “xP&A is a response to the challenges faced by enterprises seeking to exploit new digital business models and navigate current economic uncertainties… It is a platform-centric enterprise planning strategy that extends FP&A use cases beyond finance by adding resident operational applications that use the same composable vendor platform, architecture and data model in order to improve alignment. Newly added planning disciplines beyond those of the finance department include supply chain, sales, marketing, HCM and IT.”

Per our understanding, Gartner’s point is that companies need a comprehensive view across lines of business and operations, linking corporate strategy and execution. And the finance department is ideally positioned to deliver this unified view, since it already gathers financial data company-wide and performs resource allocation, planning, forecasting, and reporting. The xP&A approach helps empower CFOs to lead company-wide strategic initiatives and help optimize business outcomes.

Gartner estimates “By 2024, 70% of new financial planning and analysis projects will become extended planning and analysis (xP&A) projects.” In other words, xP&A is the way of the future. We couldn’t agree more.

How xP&A helps deck the halls

The holiday season is a vivid example of how a company’s profitability depends on more than budgets and spreadsheets. The thousands of retail businesses trying to help consumers check off their year-end shopping lists must start planning months ahead. They need to draw from the insights of departments including:

- Supply chain and sourcing – Where can we get the products we want, cost-effectively? How will they be delivered, and when will they arrive?

- Workforce planning – How many people will we need during peak season, and with what skills? How will we recruit and train them? What’s a competitive rate of pay to keep good people on staff? How do we measure performance?

- Operations – Are our stores, warehouses, and offices placed where we need them? What resources will we need to keep the lights on and everything looking fresh and festive?

- Marketing – What are the hot trends? What are consumers likely to demand? What themes do we want to promote?

Smart CFOs realize they need to factor in all these departments’ needs and outputs in order to make the best financial decisions. And we’re here for them.

Creating clear lines of sight

At Anaplan, we pioneered a cross-functional, continuous approach that we call Connected Planning. The first of its kind, having been built on a single code base, the Anaplan Platform opens up sightlines throughout the business, so the finance office can see what’s going on in real time in sales, HR, operations, and other areas of the business.

Figure 3: The “Honeycomb Effect” of Connected Planning Enables Faster, Better Decision-Making Enterprise-Wide

Whereas many FP&A systems are just beginning to consider leading-edge integration and analytics, Connected Planning delivers it. Anaplan’s Connected Planning looks at key business drivers (internal and external) to discover relationships that might otherwise be overlooked. Its Machine Learning and Artificial Intelligence capabilities let you gain insights to reveal opportunities and anticipate change, faster and more accurately than ever before.

In our opinion, the Anaplan approach is reflected in Gartner’s recommendations that organizations should develop an xP&A strategy that “enables finance to lead and coordinate broader, companywide continuous planning and performance management initiatives.” Empowered with greater visibility into live, dynamic enterprise data streams xP&A platforms let businesses “exploit rapid change and achieve improved business outcomes.”

As new tools give the finance office greater access to real-time data throughout the enterprise, Gartner suggests the office itself will transform and take on an expanded role. Using xP&A, finance leaders can guide and improve companywide planning, helping the business as a whole run more effectively.

Putting everyone on the same page

Leading-edge xP&A platforms such as the Anaplan Platform can deliver the ability to continuously access and analyze a depth and breadth of data throughout the organization. Finance and business leaders can collaborate, forecast, analyze, and plan using a single source of truth.

Since everyone has access to the same data, analysis is dramatically faster and more accurate. It becomes possible to recognize patterns and influences, test various scenarios and assumptions, and anticipate emerging risks and opportunities.

Today’s environment of continuous change means businesses must find ways to become more agile and resilient—and anticipate what’s ahead. Anaplan’s Connected Planning approach leverages the latest integration capabilities to deliver a holistic view of business performance. This unobstructed view lets finance leaders make richly informed decisions more quickly to achieve improved financial success.

The many shocks of 2020 have demonstrated why xP&A is the way forward, since resilience and agility are essential qualities in today’s business climate. Connected Planning and xP&A let you see clearly to meet current challenges and craft your vision of the future.

So as the year comes to a close, from all of us at Anaplan, we’d like to extend our sincerest thanks – to our customers, our partners, our employees, and the entire Anaplan community – for not only helping to redefine the planning space and contribute to our leadership success, but also for demonstrating true grit throughout 2020.