Planning, budgeting, and forecasting (PB&F)

Accelerate your growth strategy. Plan, budget, and forecast with confidence.

AI-infused PB&F solutions for financial planning transformation.

Bring speed, consistency, collaboration, and accuracy to your financial planning transformation

2024 Gartner® Magic Quadrant™ for Financial Planning Software

Anaplan is named a Leader for the 3rd consecutive year in the 2024 Gartner® Magic Quadrant™ for Financial Planning Software

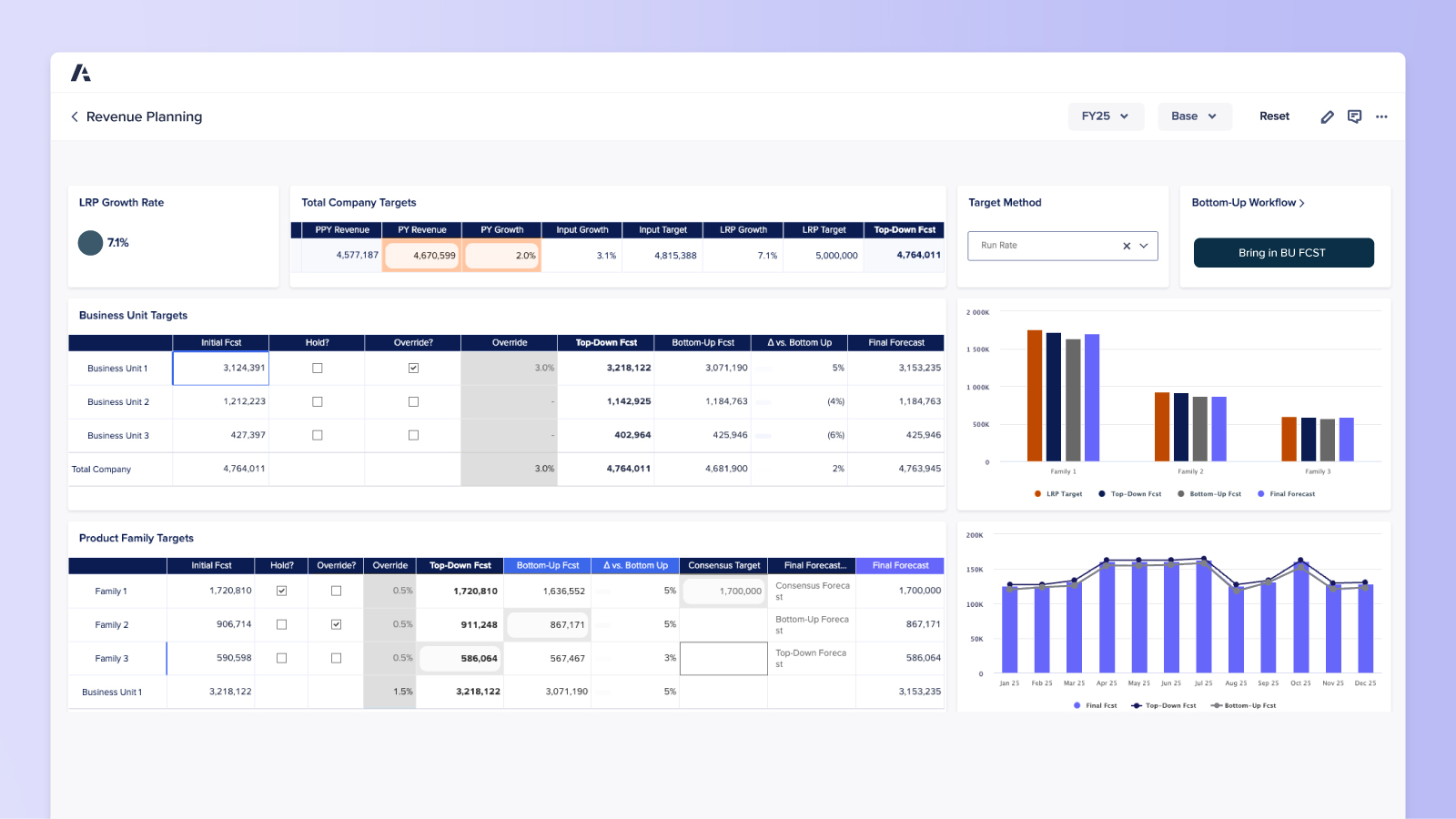

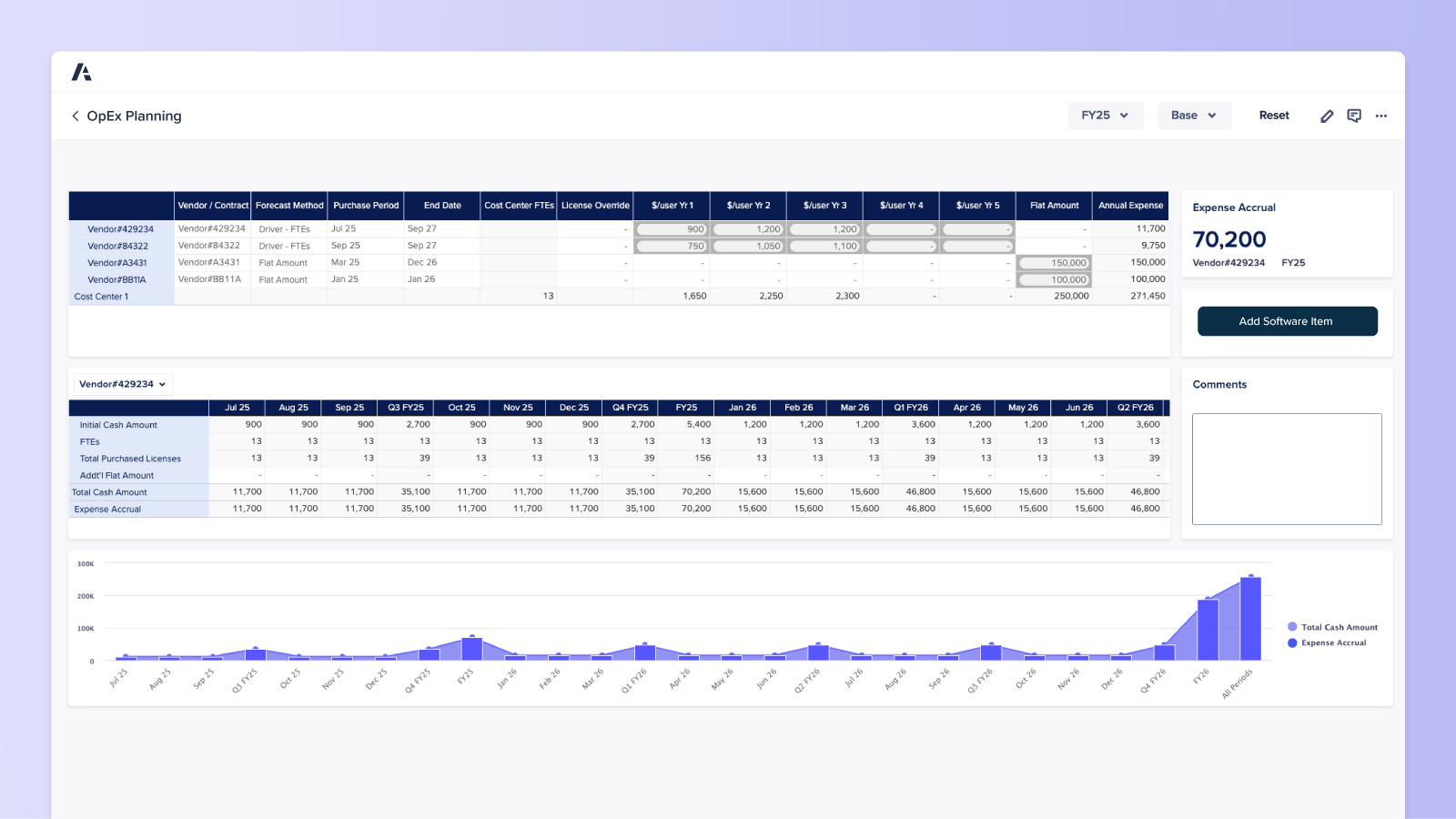

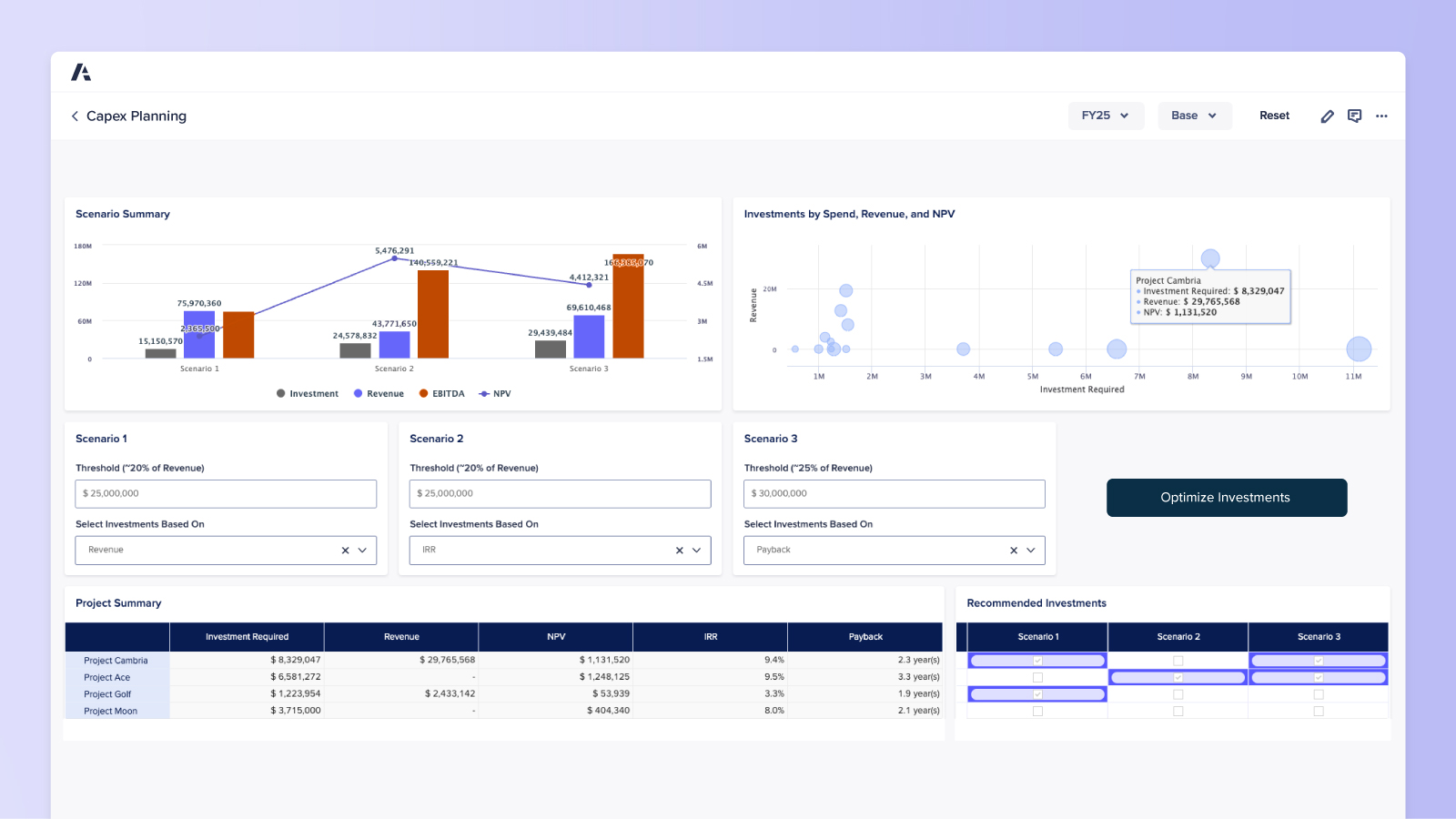

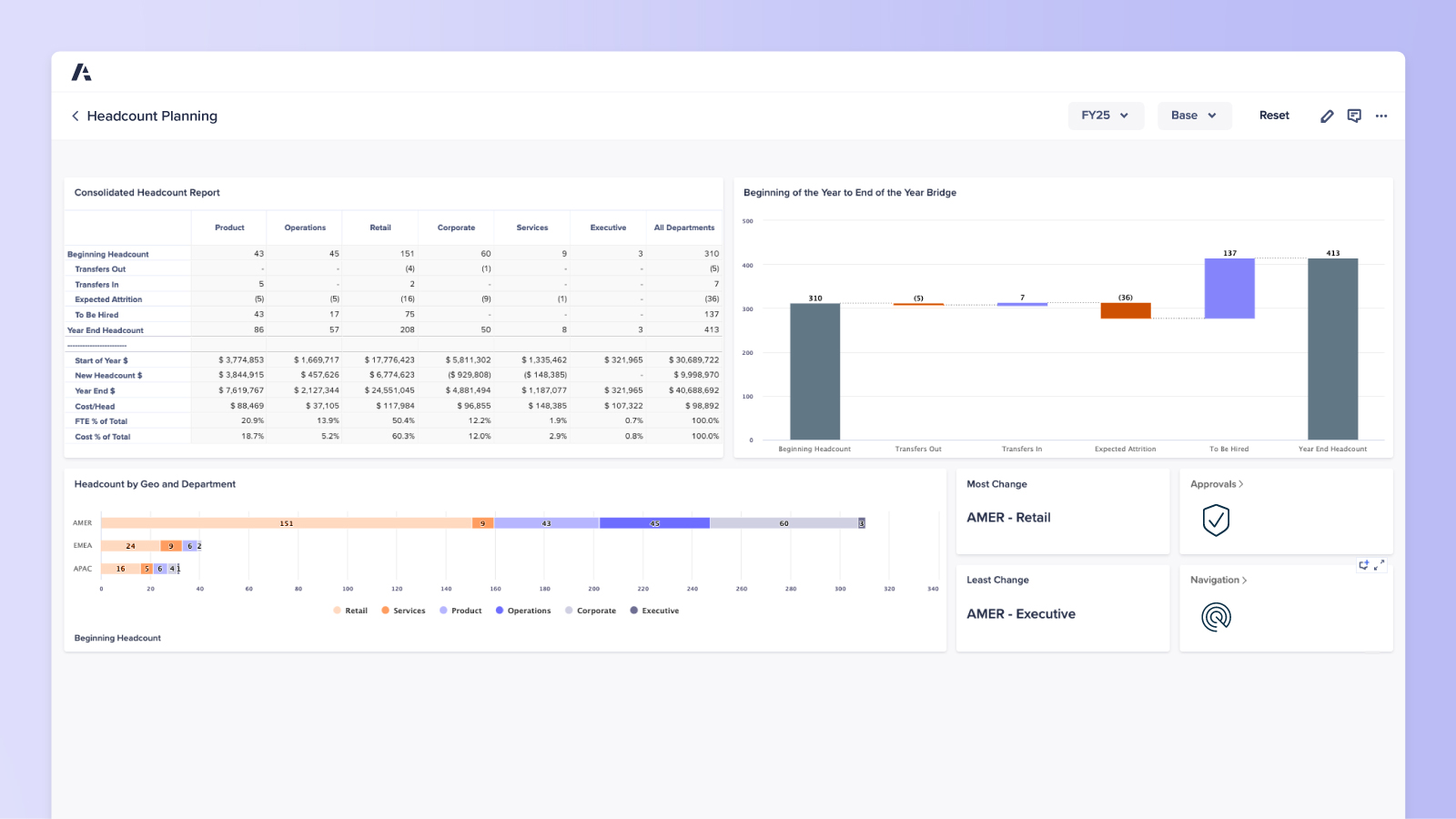

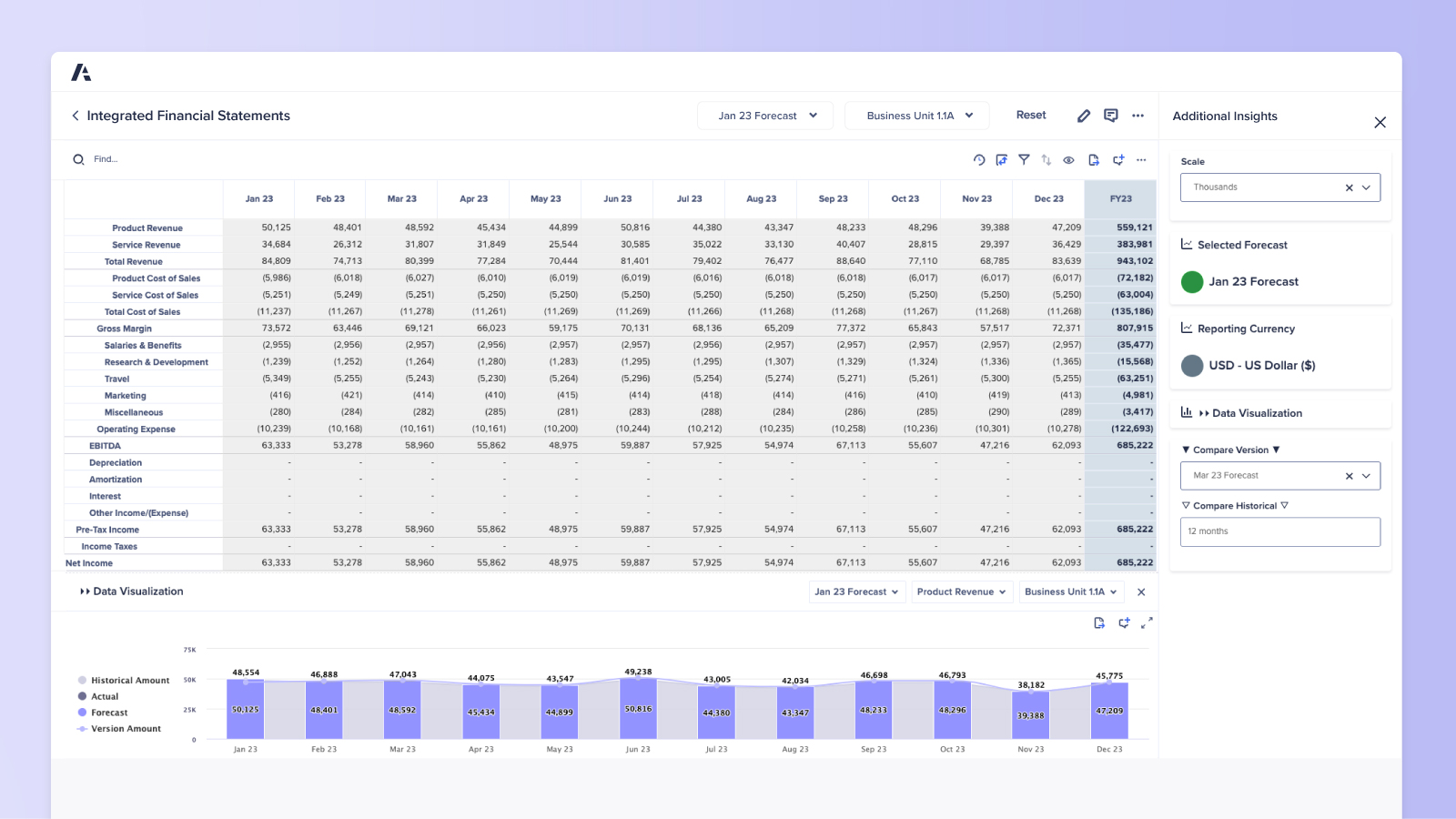

Create connected plans, fast, with an integrated approach to PB&F

Break free from siloed PB&F processes with greater accuracy, speed, and ease – all in a single platform.

Top finance leaders plan with Anaplan

Discover the platform finance leaders trust.

Be the next.

Finance teams around the world rely on Anaplan to build a modern, connected enterprise. Shouldn’t you?