Align operating expenditures with strategy, manage costs and maximize spend

This is the third article in a series of blogs that discuss how businesses can leverage technology across the entire value chain. Parts one and two can be found in the Anaplan.com blog:

Part one: How should my organization approach Connected Planning?

Part two: Revenue operations: Five considerations to help align planning across sales, marketing, and customer success

Talk to anyone with a solid tenure in finance or human resources (HR) and you’d be hard-pressed to find someone who hasn’t been part of a cost-cutting initiative at one time or another. Painful and sometimes emotional, finding new, creative, and seemingly impossible ways to trim the budget is anything but enjoyable.

One reason why this particular exercise borders on the intersection of tedium and frustration comes down to the disconnect between the higher and lower levels of management. Metrics set in the long-range plan flow off the corporate strategy, then trickle down as budget cuts from the highest levels of the organization. Cost center managers and budget-holders then have to make the mandated adjustments, even though some of the expenditures are related to mission-critical and/or day-to-day operations.

Another pain point in the budgeting process? The blanket approach businesses take in deciding which cuts they’re going to make. Widely referred to as a “peanut butter spread,” this approach tilts more toward unfavorable and further from fair because the same budget reduction is applied to everyone—regardless of whether a business unit is part of a growth strategy (versus one that is more established) or has a product line experiencing an upward trajectory (versus one headed into the sunset).

Finally, the disconnect between the budget holders and human resources creates another cyclical exercise where both parties are working with limited information and almost zero visibility. HR may be required to adjust hiring dates, compensation packages, or bonus programs to align to budgetary restrictions. However, without alignment to their finance business partners, this work is being performed in a vacuum without ensuring that operational plans are coordinated with strategy.

At its core, the operating expenditure budgeting process is far more than a cost-cutting exercise and it can provide tremendous insight across the entire value chain. Rather than serve as a point of friction, the budgeting process can help stakeholders understand how to optimally allocate resources and keep expenditures aligned with strategic plans.

Doing so is also easier than you might think. With the right approach and the right tools, departments and business functions can collaborate to build budgets that are focused on driving growth rather than simply trying to do more with less.

Value chains that can support strategic imperatives

It’s no secret that organizations today are searching for value—and an environment of mounting pressures from competition, disruption, economic uncertainty, and geopolitical climate continues to demand increasingly more of their resources. To maximize operating expenditures, the conversation about it and the approach to achieve it must go beyond collecting and consolidating budgets.

To this end, visibility, collaboration, and what-if scenario capabilities can allow organizations to be more strategic in how their resources are leveraged. Technology with these capabilities can help leaders understand where and why they can scale back, when an expenditure is required to meet growth targets, and how to better capitalize on their investments.

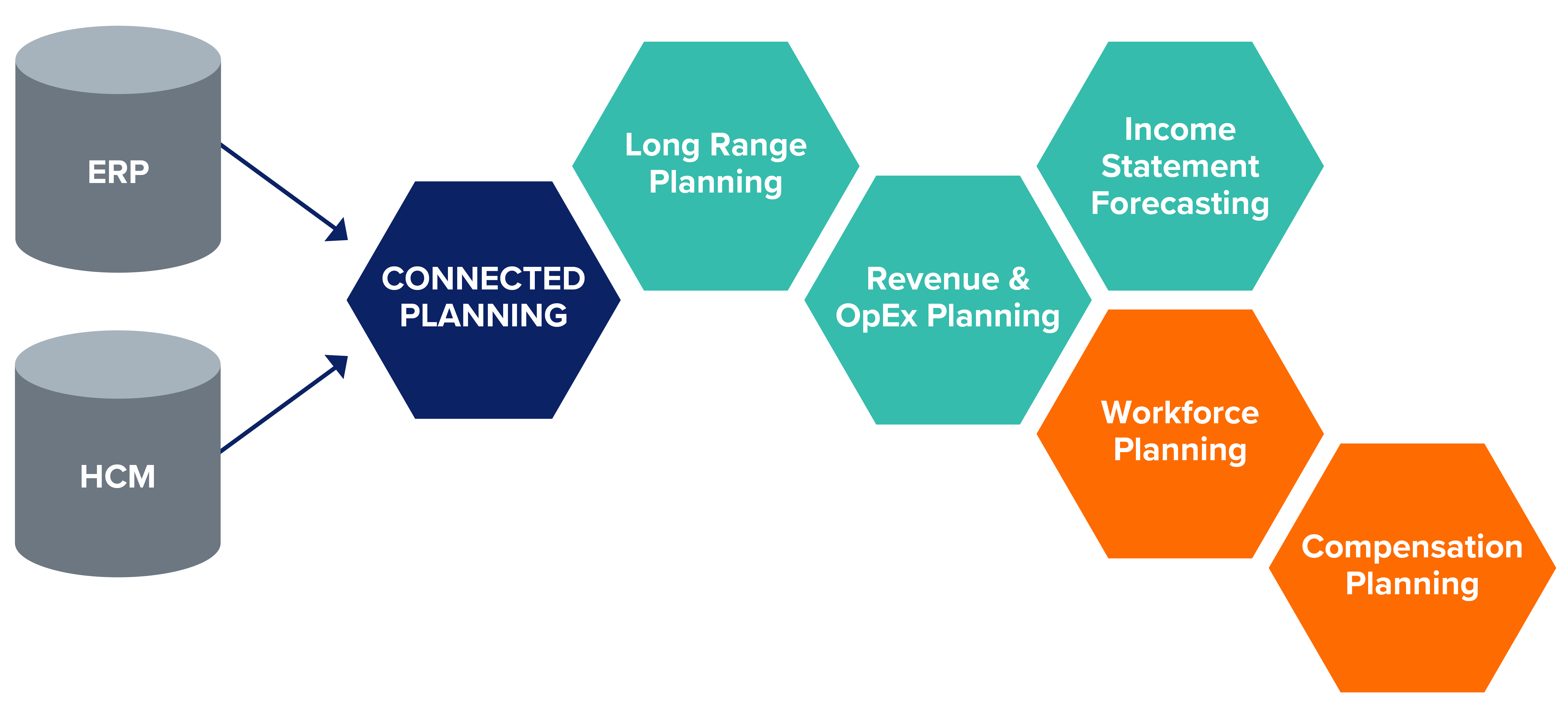

Setting strategic targets at the highest level of the organization and then allocating that information in ways that are advantageous to the business is another core component of success. Using a Connected Planning platform, in particular, is clutch here because it can provide the flexibility and visibility needed to better support such dynamic analysis and decision making.

What’s more, it can also help OpEx targets cascade throughout the business in meaningful ways by comparing budget needs and requests at granular and detailed levels, aligning with workforce plans from human resources, and generating outputs that are best for the business.

Additionally, impacts to the P&L can be evaluated in real time and scenarios can be immediately created based on changes in the leadership vision and any necessary adjustments.

From a burdensome struggle to a strategic benefit

Aligning the strategic plan to financial and operational planning processes can reveal enormous value across the organization. For example, it can allow all stakeholders and budget owners to:

- Remain focused on the targets and direction of the organization.

- Evaluate where improvements can be made in the most effective way.

- Determine how resources can be repurposed for or allocated to more optimal activities.

Further, bringing budget-holders into the conversation around desired results can help drive more aligned collaboration, negotiation, and concessions. Focusing the organization on such efforts to drive growth turns the perception of expense planning into that of a strategic process rather than just another necessary evil.

When OpEx optimization is supported by the right planning platform, it can be highly strategic—rather than burdensome—to integrate with the organization’s overall vision and provide an overarching direction for the entire organization to work toward.