May 28, 2019

11 min read

Anaplan announces first quarter fiscal year 2020 financial results

- First Quarter Subscription Revenue grew 45% year-over-year

- Dollar-Based Net Expansion Rate of 123%

SAN FRANCISCO, CA, May 28, 2019 — Anaplan Inc. (NYSE:PLAN), a pioneer in Connected Planning, today announced financial results for its first quarter ended April 30, 2019.

“We are very pleased to start our fiscal year with strong first quarter results. This is an indication of our continued success with our Connected Planning solution,” said Frank Calderoni, chief executive officer at Anaplan. “Our customers are consistently impressed with the value they receive from the results of deploying Anaplan across their enterprise. We are excited many of them will be showcasing these results at our global Connected Planning Xperience in San Francisco in June.”

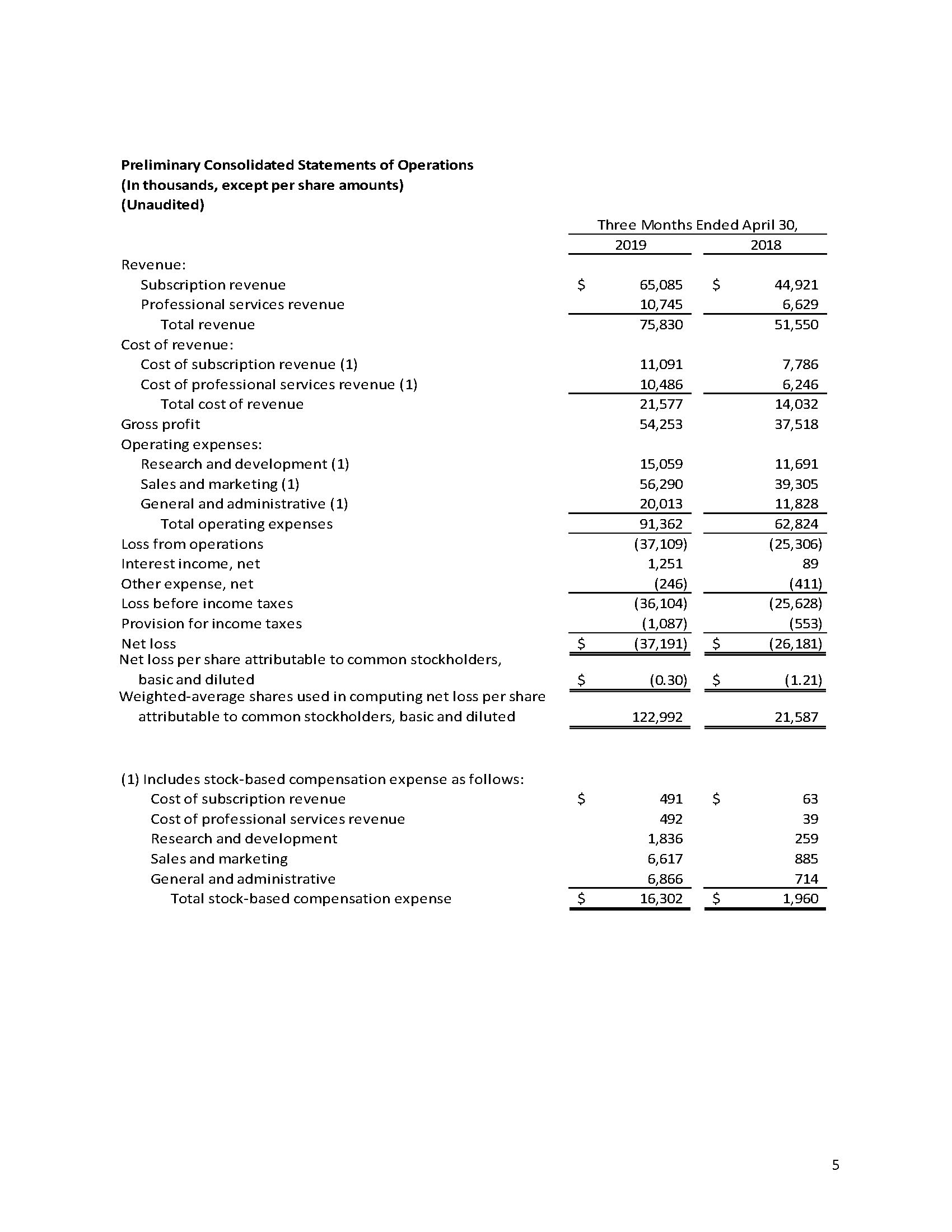

First Quarter Fiscal 2020 Financial Results

- Total revenue was $75.8 million, an increase of 47% year-over-year. Subscription revenue was $65.1 million, an increase of 45% year-over-year.

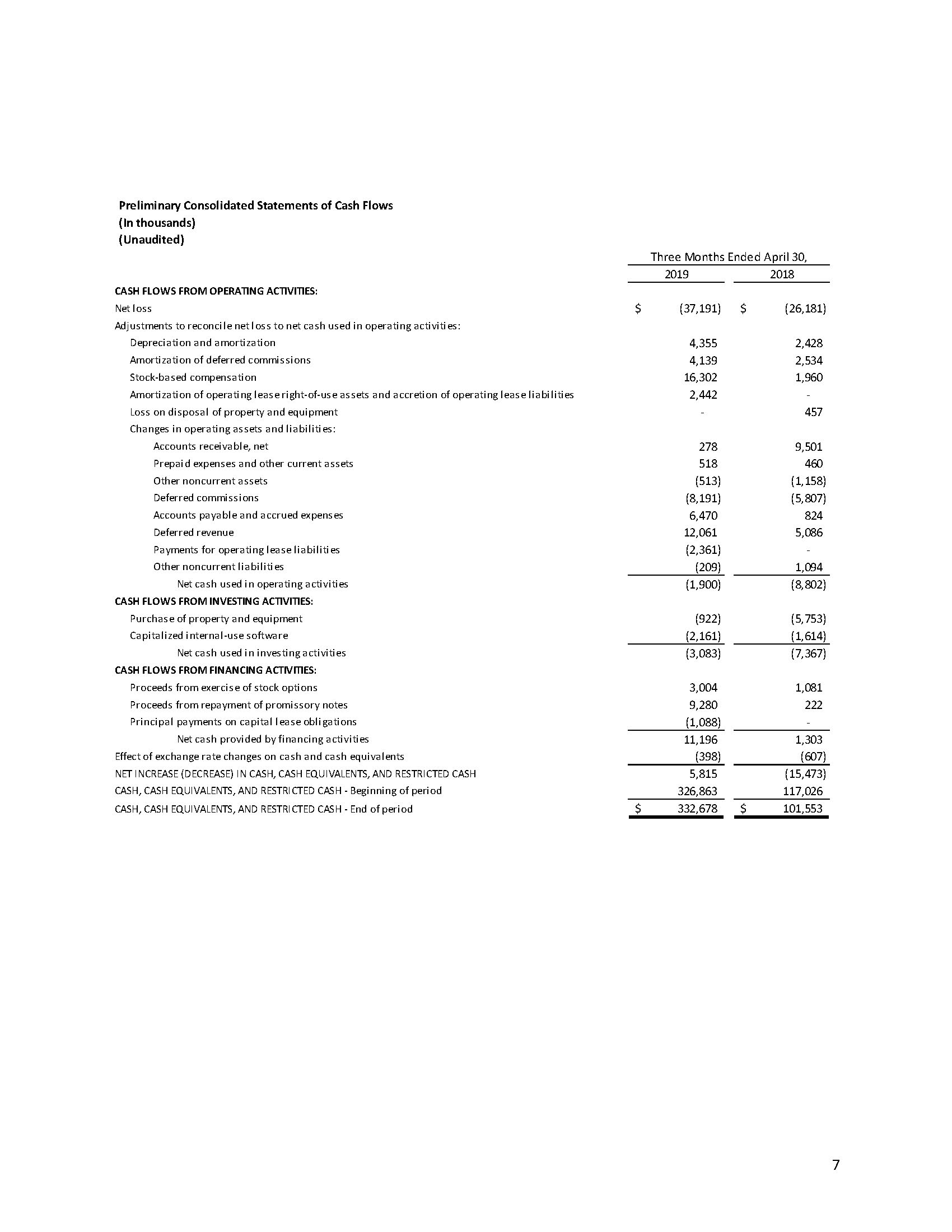

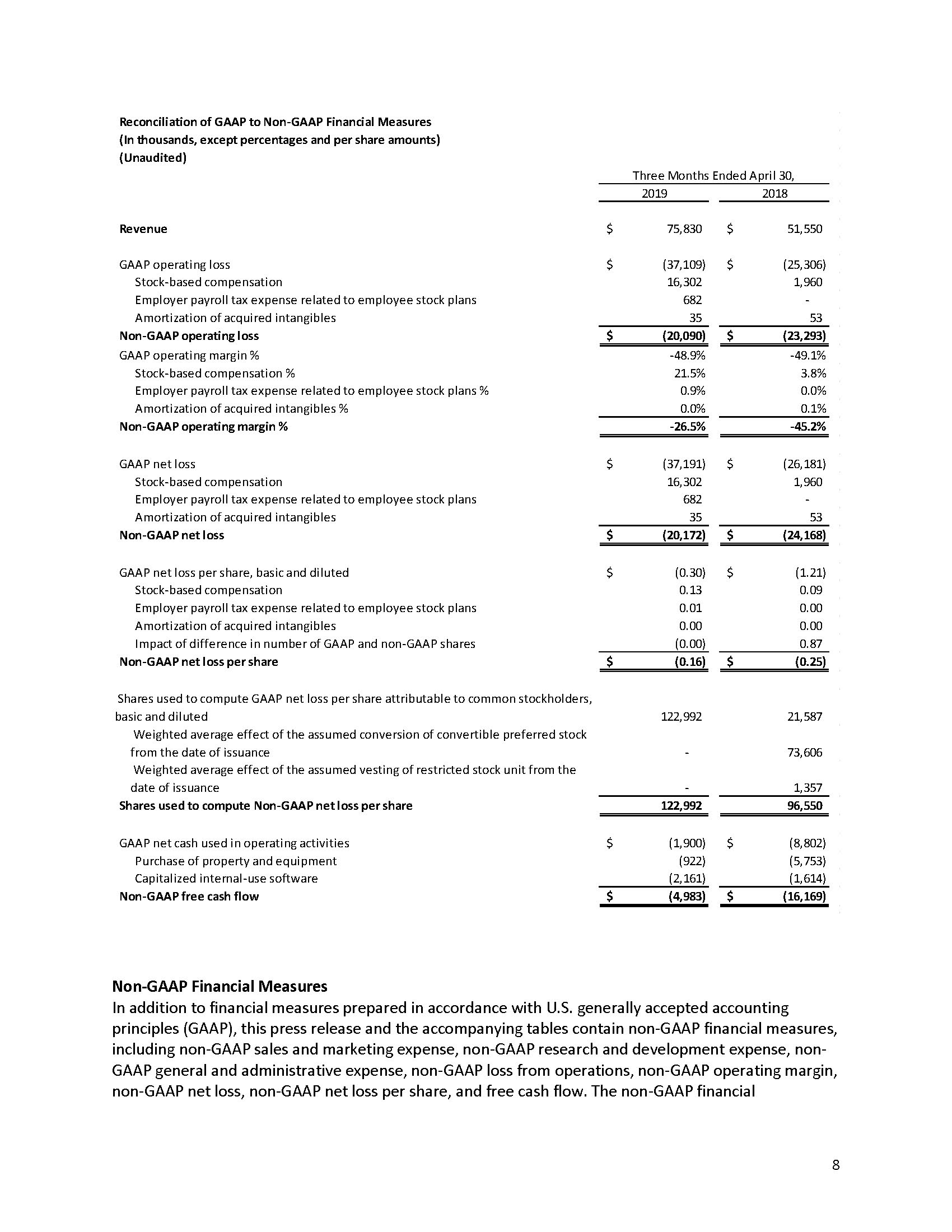

- GAAP operating loss was $37.1 million or 48.9% of total revenue, compared to $25.3 million in the first quarter of fiscal 2019 or 49.1% of total revenue. Non-GAAP operating loss was $20.1 million, or 26.5% of total revenue, compared to $23.3 million in the first quarter of fiscal 2019, or 45.2% of total revenue.

- GAAP loss per share was $0.30, compared to $1.21 in the first quarter of fiscal 2019. Non-GAAP loss per share was $0.16, compared to $0.25 in the first quarter of fiscal 2019.

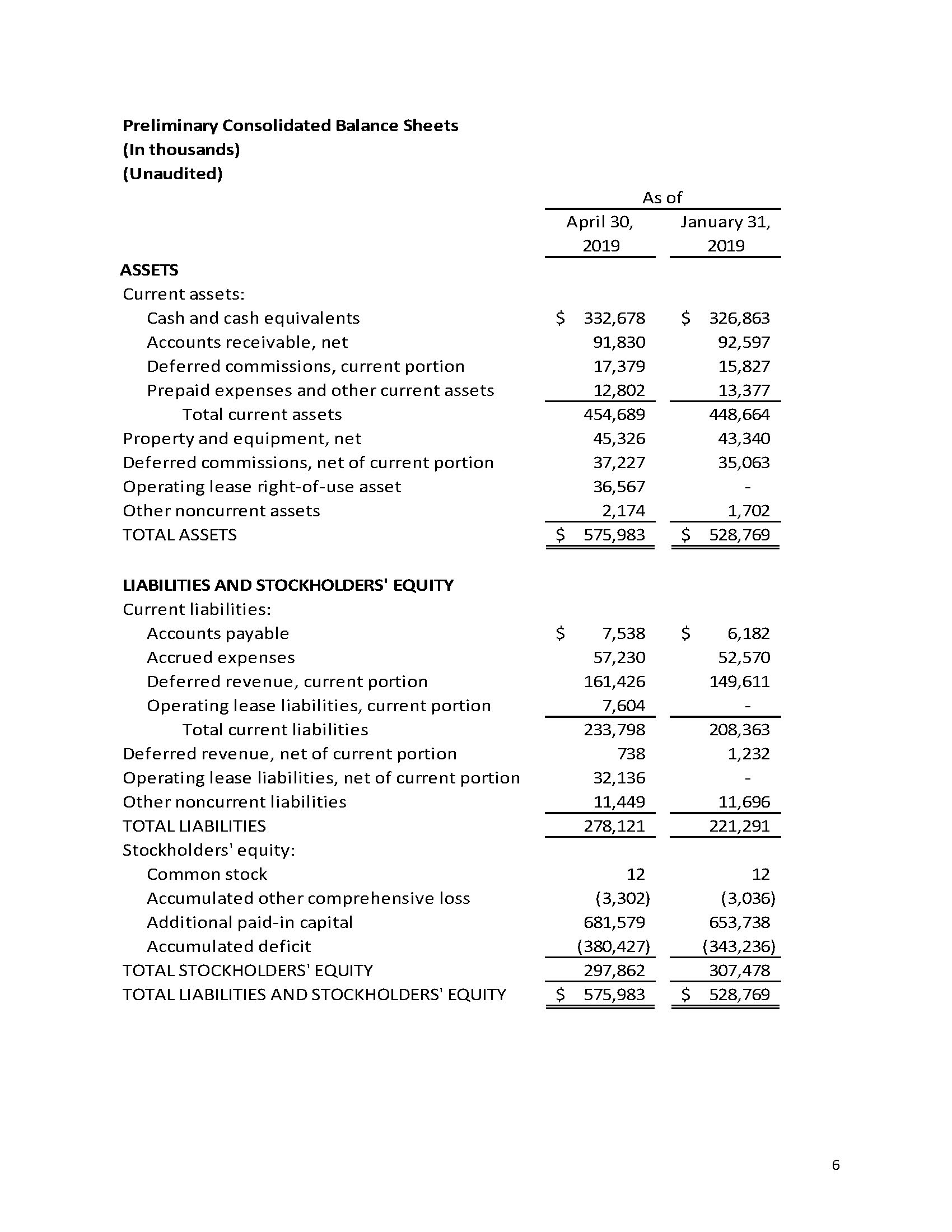

- Cash and Cash Equivalents were $332.7 million as of April 30, 2019.

Financial Outlook

The Company is providing the following guidance for its second quarter fiscal 2020:

- Total revenue is expected to be between $77.5 and $78.5 million.

- Non-GAAP operating margin is expected to be between negative 25.5% and 26.5%.

The Company is updating its previous guidance provided on February 25, 2019 for full year fiscal 2020:

- Total revenue is now expected to be between $326 and $331 million (was between $310 and $314 million).

- Non-GAAP operating margin is now

The section titled “Non-GAAP Financial Measures” below contains a description of the non-GAAP financial measures used in this press release, definitions of our operating metrics and a reconciliation of GAAP and non-GAAP financial measures is contained in the tables below. A reconciliation of non-GAAP measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, the costs and expenses that may be incurred in the future and therefore, cannot be reasonably predicted. The effect of these excluded items may be significant.

Recent Highlights

- Anaplan Positioned as a Leader in 2019 Gartner Magic Quadrant for Sales and Operations Planning Systems of Differentiation.

- MUFG Investor Services announces their choice to use Anaplan for clients’ real-time planning processes.

- Anaplan announces CPX 2019 in San Francisco, expected to welcome over 2000 attendees from around the world June 10-12.

Webcast and Conference Call Information

Anaplan will host a conference call for investors on May 28, 2019 at 5:30 a.m. Pacific Time and 8:30 a.m. Eastern Time to share the company’s financial results and business highlights. Investors are invited to listen to a live webcast of the conference call by visiting https://investors.anaplan.com. A replay of the webcast will be available for one year. The call can also be accessed live via phone by dialing (877) 823-8690 or, for international callers, (647) 689-4061 with conference ID 6973538. An audio replay will be available shortly after the call and can be accessed by dialing (800) 585-8367 or, for international callers (416) 621-4642. The passcode for the replay is 6973538.

About Anaplan

Anaplan (NYSE: PLAN) is pioneering the category of Connected Planning. Our platform, powered by our proprietary HyperblockTM technology, purpose-built for Connected Planning, enables dynamic, collaborative, and intelligent planning. Large global enterprises use our solution to connect people, data, and plans to enable real-time planning and decision-making in rapidly changing business environments to give our customers a competitive advantage. Based in San Francisco, we have over 20 offices globally, 175 partners, and more than 1,150 customers worldwide.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended, including all statements other than statements of historical fact contained in this press release and, in particular, the quotations from management, financial outlook and earnings guidance, statements about the Company’s plans, strategies and prospects, estimates of enterprise cloud-market growth, market demand, competitive position, current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, short- and long-term business operations and objectives, and financial needs. These statements identify prospective information and may include words such as “expects,” “intends,” “continue,” “plans,” “anticipates,” “believes,” 3 “estimates,” “predicts,” “projects,” “potential,” “should,” “may,” “will,” or the negative version of these words, variations of these words and comparable terminology. These forward-looking statements are based on information available to the Company as of the date of this press release and are based on management’s current views and assumptions. These forward-looking statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other factors that could cause actual results, performance or events to differ materially from those anticipated by these forwardlooking statements. Such risks, uncertainties, and other factors may be beyond the Company’s control and may pose a risk to the Company’s operating and financial condition. Such risks and uncertainties include, but are not limited to: we have a limited history of operating at our current scale and under our current strategy, which makes it difficult to predict our future operating results, and we may not achieve our expected operating results in the future; due to our history of net losses, we anticipate increasing our operating expenses in the future, and we do not expect to be profitable for the foreseeable future; our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business; because we derive substantially all of our revenue from a single software platform, failure of our Connected Planning solutions in general and our platform in particular to satisfy customer demands or to achieve increased market acceptance would adversely affect our business, results of operations, financial condition, and growth prospects; if we are unable to attract new customers, both domestically and internationally, the growth of our revenue will be adversely affected and our business may be harmed; our business depends substantially on our customers renewing their subscriptions and expanding their use of our platform and failure to achieve renewals and expansions may result in a material adverse effect on our business operations; the markets in which we participate are intensely competitive, and if we do not compete effectively, our business and operating results could be adversely affected; if we experience a security incident, our platform may be perceived as not being secure, our reputation may be harmed, customers may reduce the use of or stop using our platform, we may incur significant liabilities, and our business could be materially adversely affected; real or perceived errors, failures, bugs, service outages, or disruptions in our platform could adversely affect our reputation and harm our business; we have experienced rapid growth in recent periods and expect to continue to invest in our growth for the foreseeable future; if we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service, or adequately address competitive challenges; we could incur substantial costs in protecting or defending our intellectual property rights, and any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and our brand; our global operations and sales to customers outside the United States or with international operations subject us to risks inherent in international operations that can harm our business, results of operations, and financial condition; the uncertainty in and volatility of the broader stock market generally or the stock price of our common stock specifically may result in stockholders not being able to resell their shares at or above the price at which they purchased shares. Information concerning risks, uncertainties and other factors that could cause results to differ materially from the expectations described in this press release is contained in the Company’s annual report on Form 10-K filed with the U.S. Securities and Exchange Commission on March 29, 2019 , the “Risk Factors” section of which is incorporated into this press release by reference, and other documents filed with or furnished to the Securities and Exchange Commission. These forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date and the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made. The information contained in, or that can be accessed through, Anaplan’s website and social media channels are not part of this press release.

Investor Contact:

Edelita Tichepco

investors@anaplan.com

Media Contact:

Hannah Cho

press@anaplan.com

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release and the accompanying tables contain non-GAAP financial measures, including non-GAAP sales and marketing expense, non-GAAP research and development expense, non-GAAP general and administrative expense, non-GAAP loss from operations, non-GAAP operating margin, non-GAAP net loss, non-GAAP net loss per share, and free cash flow. The non-GAAP financial information is presented for supplemental informational purposes only, and is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. The non-GAAP measures presented here may be different from similarly-titled non-GAAP measures used by other companies.

We use these non-GAAP measures in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies and to communicate with our board of directors concerning our financial performance. We believe these non-GAAP measures, when viewed collectively with the GAAP measures, may be helpful to investors because they provide consistency and comparability with our past financial performance and facilitate period-to-period comparisons of our operating results.

There are material limitations associated with the use of non-GAAP financial measures since they exclude significant expenses and income that are required by GAAP to be recorded in our financial statements. The definitions of our non- GAAP measures may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may utilize metrics that are not similar to ours. We compensate for these limitations by analyzing current and future results on a GAAP basis as well as a non-GAAP basis and by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures. Please see the reconciliation tables at the end of this release for the reconciliation of GAAP and non-GAAP results.

We adjust the following items from one or more of our non-GAAP financial measures:

Stock-based compensation expense. We exclude stock-based compensation expense, which is a non-cash expense, from certain of our non-GAAP financial measures because we believe that excluding this item provides meaningful supplemental information regarding operational performance. In particular, companies calculate stock-based compensation expense using a variety of valuation methodologies and subjective assumptions.

Employer payroll tax expense related to employee stock plans. We exclude employer payroll tax expense related to employee stock plans, which is a cash expense, from certain of our non-GAAP financial measures because we believe that excluding this item provides meaningful supplemental information regarding operational performance. In particular, this expense is tied to the exercise or vesting of underlying equity awards and the price of our common stock at the time of exercise or vesting, which may vary from period to period independent of the operating performance of our business.

Amortization of acquired intangible assets. We exclude amortization of acquired intangible assets, which is a non-cash expense, from certain of our non-GAAP financial measures. Our expenses for amortization of intangible assets are inconsistent in amount and frequency because they are significantly affected by the timing, size of acquisitions and the inherent subjective nature of purchase price allocations. We exclude these amortization expenses because we do not believe these expenses have a direct correlation to the operation of our business.

Internal-use software. We include capitalization and the subsequent amortization of internal-use software, which is a non-cash expense, in certain of our non-GAAP financial measures. We capitalize certain costs incurred for the development of computer software for internal use and then amortize those costs over the estimated useful life. Capitalization and amortization of software development costs can vary significantly depending on the timing of products reaching technological feasibility and being made generally available. Moreover, because of the variety of approaches taken and the subjective assumptions made by other companies in this area, we believe that including the effects of capitalized software costs allows investors to make more meaningful comparisons between our operating results and those of other companies.

Purchase of property and equipment. We include purchase of property and equipment in certain of our non-GAAP financial measures, such as free cash flow. Our management reviews cash flows generated from operations after taking into consideration capital expenditures such as purchase of property and equipment as these expenditures are considered to be a necessary component of ongoing operations.

Operating Metrics

Annual recurring revenue (ARR) is calculated as subscription revenue already booked and in backlog that will be recorded over the next 12 months, assuming any contract expiring in those 12 months is renewed and continues on its existing terms and at its prevailing rate of utilization.

Dollar-based Net Expansion Rate is calculated as the ARR at the end of a period for the base set of customers from which we had ARR in the year prior to the calculation, divided by the ARR one year prior to the date of calculation for

that same customer base.