Talent strategy for maximizing employee engagement Aligning finance and human resources functions is critical to strategic goals. Now more than ever, organizations look at workforce planning with a deep understanding of human capital and its impact on both cost and revenue. Talent strategy includes understanding the qualities of top performers, improving hiring and recruiting success, and identifying skills-needs gaps. Use Anaplan analysis and forecasts to align strategy for driving organizational success. Empower employees to feel improved engagement and motivation. Encode your strategies to manage career progression, retention, succession, and churn.

FINANCE

Anaplan for Operational Planning

Synchronize enterprise-wide financial and operational planning to drive ideal financial outcomes.

Transform your business with Connected Planning

Execute your organizational strategy with enterprise-wide line of sight, a single trusted system of record, and actionable, real-time signals. Anaplan is hyperscale computing that empowers you to drive revenue, improve margins, manage costs and coordinate talent. Align across finance, sales, supply chain, human resources, and marketing. Take control with orchestration across your organization to ensure the best financial outcomes. Use continuous scenario planning to pivot with agility and maximize resilience.

Operational planning and reporting to execute strategy

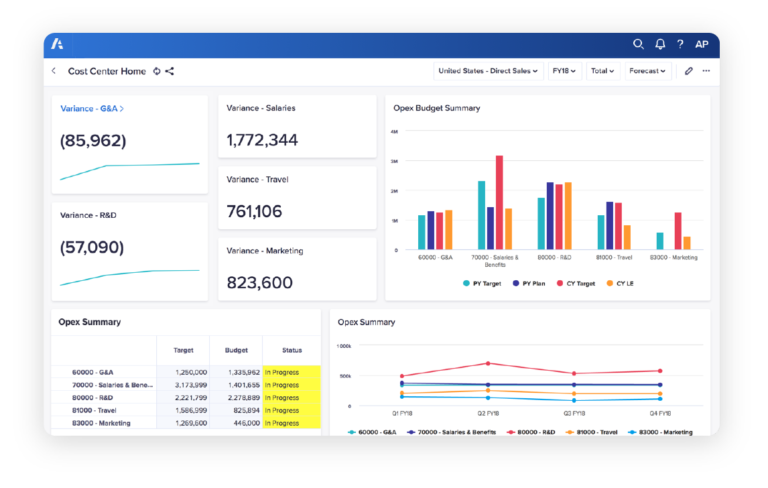

Alignment of bottom-up plan detail to top-down targets Departmental budgeting and forecasting provide bottom-up detail to meet top-down targets set in the strategic plan. Cost center managers and budget holders require levels of detail that often differ from one department to the next. This process requires agility and the capacity to quickly deploy multiple scenarios to analyze driver impact and outcomes. Anaplan provides flexibility and ease of use and keeps detailed budgets aligned to targets for rapid analysis of gaps and overages.

Aligning the revenue engine for growth and success Revenue target setting demands collaboration and consensus between finance and sales organizations. Strategic targets must drive the revenue plan and P&L forecast. The revenue forecast connects to the sales planning process owned by sales leadership. These processes are deeply intertwined. Align these processes across finance and sales to ensure that territory and quota forecasts support desired behavior and outcomes. Create multiple scalable forecasts critical for evaluating possibilities and potential results. Allow for adjustments based on market dynamics, competitive actions, geopolitical climate, and other forces. Convert constant change to your advantage.

Demand-planning accuracy and alignment with sales forecasting is critical to your business and cash flow. Link processes with collaboration, visibility, and accountability to drive the best outcomes. Break down silos, eliminate costly spoilage and shrinkage. Coordinate efforts to support organizational strategy.

Tell the story behind the numbers with visually engaging dashboards and management reports to quickly align on the facts and take action. Collaborate with multiple contributors and dynamically link data to confidently share with various stakeholders on the platform or through our powerful connectors with Workiva, Power BI, Micrsoft Office and Tableau.

Operational Planning resources

The power of Anaplan to apply automation and standardization to a fast-moving company like Groupon is really powerful.Megan Carrozza, Finance Manager and Master Anaplanner, Groupon

Get started with Anaplan today