Optimizing territory and quota for medical device sales productivity

Effective sales planning can be challenging, but when done well, organizations are four times more likely to achieve sales objectives.

Authors:

Nick Joyce, Business Development Manager – Life Sciences at Twelve Consulting Group

Tara Rockers, Business Development Manager – Life Sciences at Twelve Consulting Group

The medical device market is expected to grow from $192 billion in 2023 to a staggering $291 billion by 2030 (Fortune Business Insights). What does this rapid growth mean for medical device sellers? Rapidly changing regulations, competitor landscapes, and customer preferences demand dynamic territory adjustments and flexible quotas. Given the nature of this complexity, medical devices organizations need to focus on improving their sales planning.

An effective sales plan is four times more likely to achieve sales objectives, which directly impacts the bottom line. More equitable territories and attainable targets foster an environment of lower turnover and reduce hiring costs. Happy, trusting, fairly paid reps sell more — creating a real financial advantage for sales leaders.

Operating in a strictly regulated environment with a high degree of precision and compliance, medical device organizations face many hurdles. This blog explores how a robust enterprise performance management platform can revolutionize sales performance management (SPM) and territory and quota (T&Q) strategies, providing data-driven insights, enhanced efficiency, regulatory compliance, and a competitive edge in today's dynamic market.

When done well, sales planning works

More likely to achieve

sales objectives

More likely for sales

reps to hit quotas

More likely to accurately

estimate potential in

customers and market

But while most recognize the benefits, the reality is that effective sales planning can be challenging

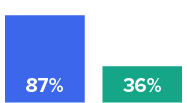

Sales goal setting

87% consider it important

36% say they’re good at it

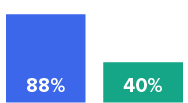

Incentive compensation

88% consider it important

40% say they’re good at it

Territory setting

76% consider it important

42% say they’re good at it

20-40%of firms think that they do the right amount of sales planning, depending on type

38-53% of firms are late with sales planning, depending on type

*2022 Sales Management Association Research Report

Major T&Q challenges for medical device companies

Sales leaders experience various challenges when confronted with the ever-shifting landscape of T&Q management. We outlined the most common challenges our customers encounter:

- Dynamic Market: The first hurdle arises from the dynamic nature of the market, characterized by rapid technological advancements including remote patient monitoring (RPM), regulatory changes, and demand fluctuations. Changes in insurance coverage for RPM technologies can alter market demand, as the focus of sales efforts are beginning to move from hospitals/clinics to patients directly and home healthcare providers. Plus, the adoption of these new medical technologies can also be unpredictable across different regions and patient demographics, which makes assigning territories and setting quotas very challenging.

- Ensuring Equitable Quota Allocation: Since sales team composition and performance can vary significantly, ensuring fairness in quota allocation is another challenge within this very dynamic market. Non-standardized processes and disparity in quotas can demotivate sales teams, thereby negatively impacting overall performance. Additionally, the manual administration of these processes adds to the burden, consuming valuable time and leaving room for potential errors, which can be very costly. Unoptimized territory assignments and imbalanced workloads lead to wasted resources and missed opportunities in high-potential areas.

- High Turnover Rate: Another major challenge is the turnover rate for sales representatives can be high. Sales managers need to understand this is not a static market; territories and quotas need constant adjustment to meet the diverse buyer portfolio whether that is hospitals, clinics, or individual practitioners as well as the complexity and variation of the product mix. Managing territories and quotas during staff transitions and ensuring that new sales reps are onboarded effectively can be a difficult task.

How to solve T&Q challenges with SPM software

Utilizing SPM software can simplify territory management and quota setting for sales organizations. Through data analytics, the software balances territories based on market potential and ensures quotas are set based on historical sales data and individual capabilities. This results in efficient territory allocation, realistic quotas, and a motivated salesforce. Here's how SPM software can contribute to T&Q success:

- Real-time and Seamless Integration: SPM software seamlessly integrates with CRM and sales crediting or incentive compensation systems, ensuring a smooth flow of data and eliminating the need for manual synchronization. Being in a complex market, this allows for real-time updates and accurate reporting, empowering sales managers with the most current insights, and more time for planning versus making ad hoc adjustments or utilizing unoptimized plans.

- Rapid Territory Plan Design and Optimization: Companies can design and optimize territories rapidly across multiple dimensions with SPM software. Whether it's hierarchy, geography, industry, product, division, named account, or more, a platform’s flexibility enables sales managers to create tailored territory plans that align with their unique purchasing behaviors within the various medical device sectors. Being able to keep up with such a dynamic market not only provides a competitive advantage in the industry, but also promotes lower attrition and more motivated sales reps.

- Easy Rollout of New Territory Plans: As companies grow and evolve, SPM platforms make it simple to roll out new territory plans that support changing go-to-market strategies and corporate goals. With just a few clicks, sales managers can ensure that their teams are aligned with the latest business priorities and ready to seize new opportunities. Managing territories for niche products or markets with limited customer density requires specialized planning approaches.

- Standardization: SPM software allows for territory and quota setting models to be built across multiple business units to streamline account assignment processes, improve accuracy, and allow for flexible data validation/visualization to enable automated aggregation of quotas. Factors like reimbursement policies, tender processes, and physician preferences influence quota allocation and territory design and need to be accounted for and ensure a competitive yet equitable quota allocation.

- Compliance and Audit Trails: With strict compliance in the industry, SPM platforms offer audit trails and compliance features to ensure that T&Q management processes adhere to regulatory requirements and company policies, especially when dealing with sensitive patient data or promoting specific devices.

A customer case study

A multinational medical device manufacturer, with annual revenue upwards of $15 billion, set out to enhance their T&Q planning by migrating from Excel to an SPM platform that also encompassed their ICM. Facing the challenge of streamlining T&Q management across diverse divisions like cardiology, orthopedics, urology, and diabetes, the company needed a solution that could cater to their varied product lines while maintaining standardization.

The chosen software offered the necessary flexibility for customization according to their unique business needs, while also ensuring a consistent yet flexible architecture. This allowed a singular center of excellence (CoE) team to effectively oversee T&Q management across all divisions. The transition eliminated the need for version control, as T&Q management became a real-time process with multi-user access, fostering enhanced collaboration across different systems and business units.

The SPM platform brought versatility in quota setting, allowing monthly, quarterly, semi-annual, or annual adjustments. It provided options for target setting based on tiers or unit/pricing growth and facilitated quota transfers. The result was a more streamlined account alignment process, encompassing both historical and future alignments. This shift not only improved accuracy, but also introduced flexible data visualization and validation, along with enabling automated aggregation of quotas — all within a single SPM platform.

Achieving effective sales planning

Medical device sales leaders who embrace SPM technology not only enhance sales operations, but also gain valuable insights into profitable sales tactics and territories. While static plans struggle to adapt, a data-driven approach positions teams to make informed adjustments to their strategies, increasing their ability to not just meet but exceed sales targets.

With its multifaceted benefits, an SPM platform is a strategic asset for any medical device company aiming to optimize T&Q management and embrace precision, compliance, and growth in the industry.