Anaplan solutions

Solve your unique and complex challenges — right here, right now

AI-infused, scenario planning, analysis, and reporting solutions to align your organization around optimized decision-making.

Enterprise-grade solutions to streamline cross-functional collaboration

- Finance

- Sales and marketing

- Supply chain

- HR and workforce

Finance

Ignite exceptional performance and close faster with AI-infused, financial planning and analysis and next-gen consolidation and reporting.

Sales and marketing

Outpace the competition and hit your revenue targets with solutions that optimize go-to-market investments and streamline resource allocation.

Supply chain

Overcome disruption and complexity by seamlessly connecting your supply chain strategy to execution, across functions, and from suppliers to customers.

HR and workforce

Future-proof your workforce with best-in-class planning solutions that ensure the right talent is in the right place, at the right time and cost.

No two industries are alike — trust the platform that understands yours

- Energy

- Financial services

- Healthcare and life sciences

- Manufacturing

- Public sector and higher education

- Retail and consumer

- Technology, media, and telecommunications

- Professional and business services

Energy

Ensure business resilience and capitalize on opportunities through market uncertainty, regulatory shifts, and supply chain complexities.

Financial services

Move at market speed with agile, collaborative planning, forecasting, and reporting, and break down silos to minimize risk and drive growth.

Healthcare and life sciences

Reduce manual tasks and processes to focus on high-value activities that improve patient care and innovation.

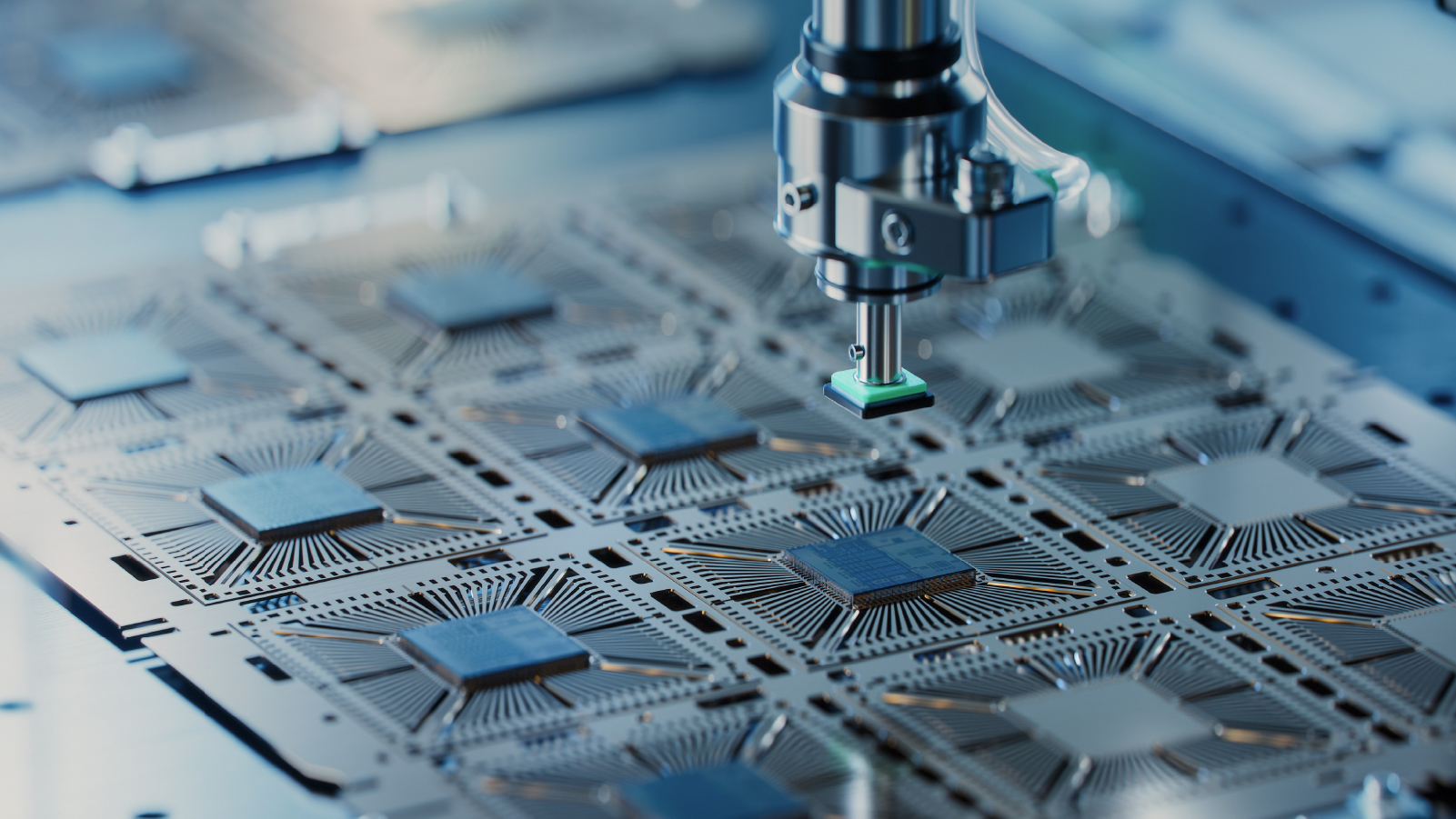

Manufacturing

Navigate complexity and disruption while fostering innovation and profitable growth with unified data insights across your organization.

Public sector and higher education

Connect planning, budgeting, and reporting processes to reduce cycle times, enhance transparency, and optimize decision-making.

Retail and consumer

Make faster decisions with data-driven shared strategies — from production to purchase — based on real-time insights into market trends.

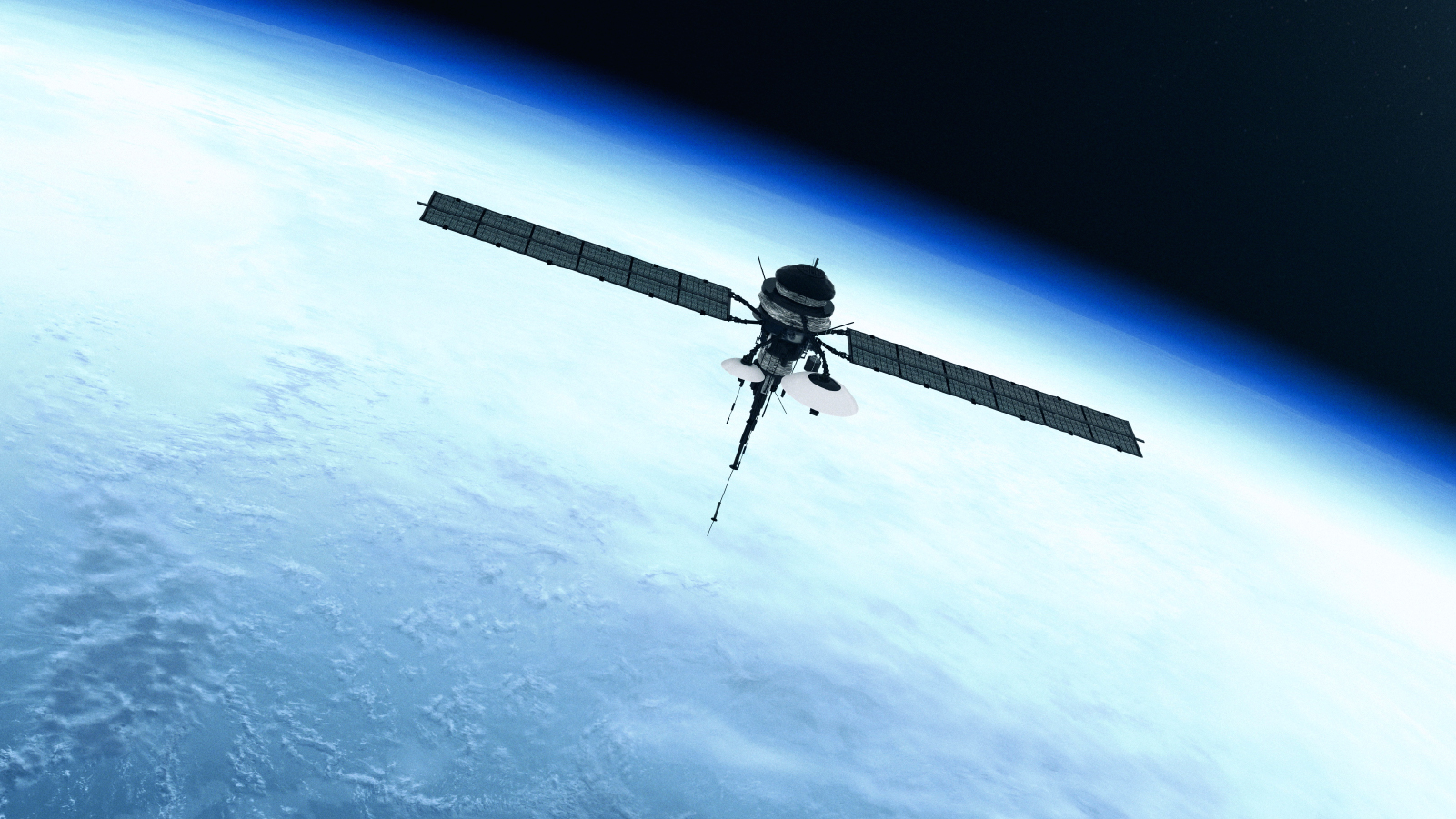

Technology, media, and telecommunications

Align commercialization strategies with consumer demand, forecast for revenue change, and optimize your workforce.

Professional and business services

Deliver exceptional service and increase profitability by optimizing resource allocation and planning processes.

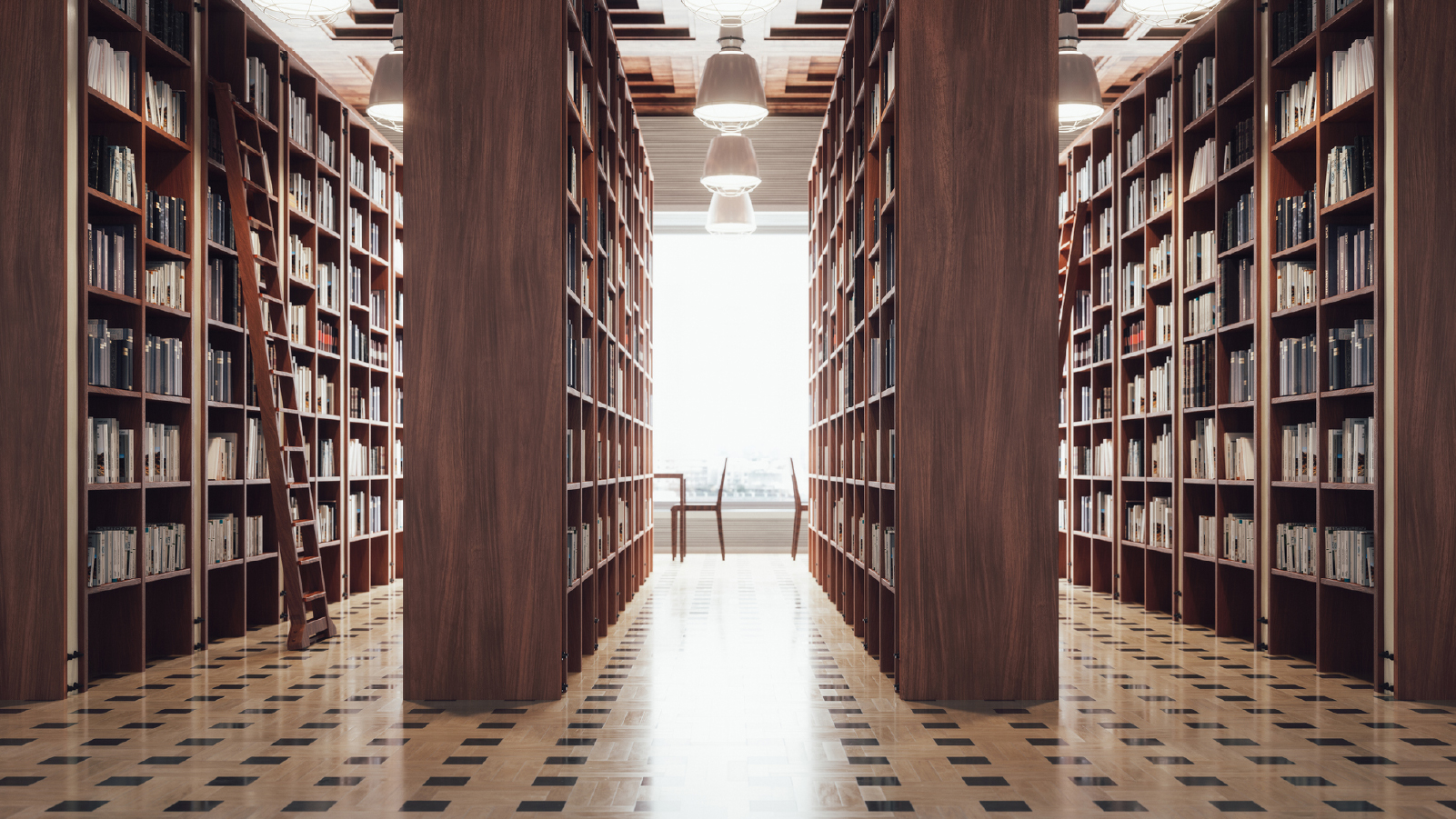

Connect your financial, strategic, and operational plans

From finance to supply chain, sales and marketing to HR

— unite your planning processes.

An expansive global partner ecosystem

More than 2,500 of the world’s top brands outpace their competition with Anaplan

Discover the platform industry leaders trust.

Be the next.

Organizations around the world rely on Anaplan to build a modern, connected enterprise. Shouldn’t you?